Opportunity cost is the implicit cost incurred by missing out on an investment, either with one's time or money. Because resources are finite, investing in one opportunity causes another opportunity to be forgone. It's the value of what you're giving up to pursue the current course of action. Decisions typically involve trade-offs, and understanding opportunity cost helps ensure that resources are allocated most efficiently. Every decision made, whether it's in our personal lives, investments, or business endeavors, comes with a sacrifice. This sacrifice is not always monetary. It can be in terms of time, resources, or any other benefit foregone. For instance, if you spend an evening studying for an exam rather than going to a movie, your opportunity cost is the enjoyment and relaxation you would've gotten from the movie. The concept of opportunity cost helps individuals and businesses understand the potential outcomes they forego when making a decision. Efficient resource allocation is vital as it helps individuals and businesses direct their limited resources, such as time, money, and manpower, towards the most valuable opportunities. By considering opportunity cost, decision-makers can prioritize investments or projects that offer the highest returns and optimize resource utilization, leading to improved productivity and overall effectiveness. Opportunity cost facilitates rational decision-making by encouraging individuals to assess the trade-offs involved in various choices. By comparing the benefits and drawbacks of different alternatives, decision-makers can make more informed and logical decisions that align with their objectives and long-term goals, minimizing the risk of regret or suboptimal outcomes. Taking into account opportunity cost enables individuals and organizations to focus on endeavors that generate the greatest returns and benefits. By identifying and pursuing opportunities with the most significant potential gains, they can capitalize on advantageous situations and achieve higher levels of success and prosperity. Opportunity cost isn't always quantifiable in monetary terms, but when it can be, it's computed by taking the difference between the return on the chosen option and the return on the forgone option. For instance, if you invest $1000 in stock A which yields a 5% return over the year but could have invested in stock B with a 7% return, the opportunity cost is the 2% difference. Every dollar spent today could have been saved or invested for a potentially higher value in the future. When someone decides to buy a luxury item instead of saving, the opportunity cost could be the potential compound interest earned over the years. Understanding these costs helps individuals make informed financial choices that align with their long-term goals. In business, opportunity costs impact various areas from production decisions to capital allocation. For instance, a company might have to decide between launching a new product or upgrading an existing one. The opportunity cost will be the benefits the company might forgo from the option they don't choose. Similarly, in economics, nations might face decisions on producing military equipment versus consumer goods. The goods not produced represent the opportunity cost. Opportunity cost plays a crucial role in evaluating the potential returns of different investment options. Investors consider the foregone returns from the next best alternative, helping them make informed choices, maximizing their overall portfolio performance and achieving their financial goals effectively. Diversification, the practice of spreading investments across various assets or asset classes, can minimize potential opportunity costs. Instead of putting all funds into a single investment and risking missing out on better-performing alternatives, diversification allows investors to capture gains across different areas. Time is a finite resource. Effectively managing and prioritizing tasks can significantly reduce the opportunity cost associated with wasted time. Whether it's in personal endeavors or business projects, efficient time management ensures that the most valuable tasks get attention first. Before making decisions, especially significant ones, it's vital to assess and compare all available alternatives. This comparison doesn't just consider the immediate benefits but also looks at long-term outcomes and potential missed opportunities. Having a comprehensive view of all options ensures that the decision made has the least opportunity cost. Company ChooseRight assesses an investment in a $100,000 machine that will net a profit of $150,000 over its useful lifetime of 10 years. In isolation, the investment is perceived to be wise because it nets a positive return. However, before finalizing the investment in the new machinery, company ChooseRight estimates the opportunity cost if the funds were invested elsewhere. They estimate a $200,000 return over the next 10 years by investing in an employee training program, expanding the marketing budget, and upgrading an outdated payroll system. Company ChooseRight therefore decides that although the investment in new machinery would return a profit, the opportunity cost of the investment suggests that the funds should be invested elsewhere. Businesses often establish a minimum internal rate of return, or IRR, based on historical and future opportunity costs. Future estimated cash flows are discounted by a company's IRR to calculate the net present value of an investment. If the net present value of an investment is positive, the estimated return is greater than its opportunity cost. Therefore, a positive net present value suggests funds invested in this opportunity provide a return greater than if the funds were invested elsewhere. Opportunity cost can be used to inform any decision, from investing in a security to what leisure activities one does during their free time. Opportunity cost is the implicit cost incurred by forgoing an investment, whether in time or money, plays a crucial role in various aspects of decision-making. Throughout personal finance, business endeavors, and investment decisions, individuals and organizations face trade-offs that can impact their long-term outcomes. Efficient resource allocation enables optimal utilization of limited resources, leading to improved productivity and effectiveness. Rational decision-making, facilitated by considering opportunity cost, helps align choices with objectives and minimize the risk of regret or suboptimal outcomes. Maximizing returns and benefits becomes achievable by identifying and pursuing opportunities that offer the most significant potential gains. By understanding and quantifying opportunity cost, individuals and businesses can make informed choices that align with their goals, leading to better financial outcomes and more effective resource management. Opportunity cost serves as a valuable tool in guiding decisions, ensuring that each choice is evaluated in the context of its potential benefits and sacrifices.Opportunity Cost Definition

Understanding Opportunity Cost

Significance of Opportunity Cost

Efficient Resource Allocation

Rational Decision Making

Maximizes Returns and Benefits

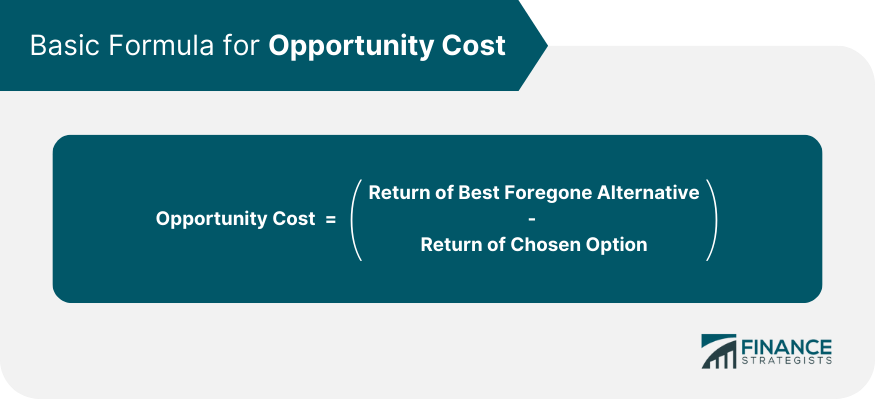

Calculating Opportunity Cost

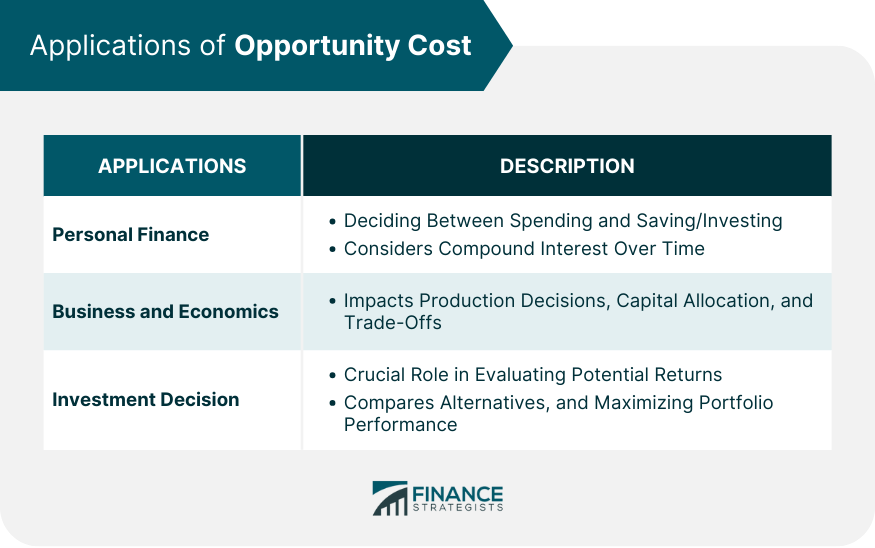

Applications of Opportunity Cost

Personal Finance

Business and Economics

Investment Decision

Strategies to Minimize Opportunity Cost

Diversify Investments

Prioritize and Manage Time

Compare Alternatives

Example of Opportunity Cost

Informing Decisions With Opportunity Cost

Conclusion

Opportunity Cost FAQs

Opportunity cost is the implicit cost incurred by missing out on an investment, either with one’s time or money.

Because resources are finite, investing in one opportunity causes another opportunity to be forgone.

Opportunity cost can be used to inform any decision, from investing in a security to what leisure activities one does during their free time.

Businesses often establish a minimum internal rate of return, or IRR, based on historical and future opportunity costs.

Future estimated cash flows are discounted by a company’s IRR to calculate the net present value of an investment. If the net present value of an investment is positive, the estimated return is greater than its opportunity cost.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.