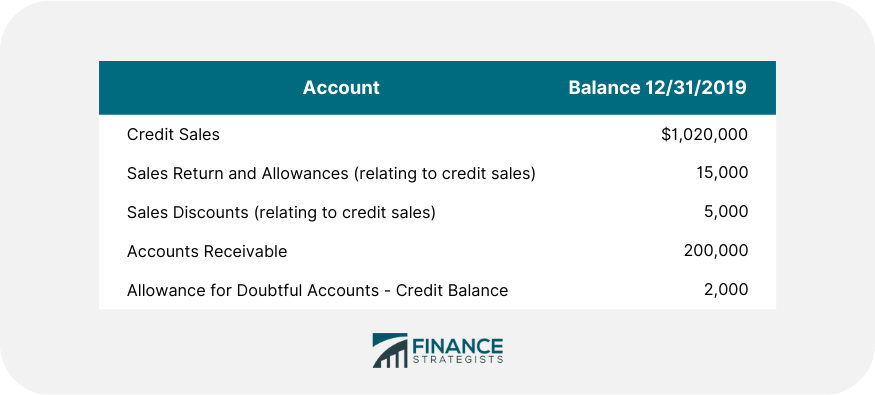

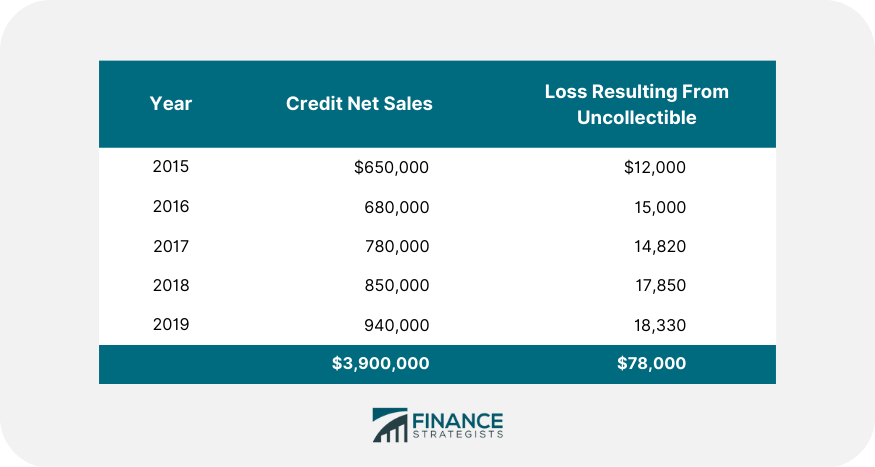

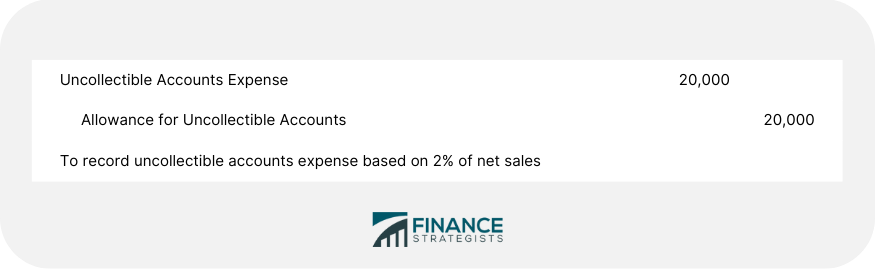

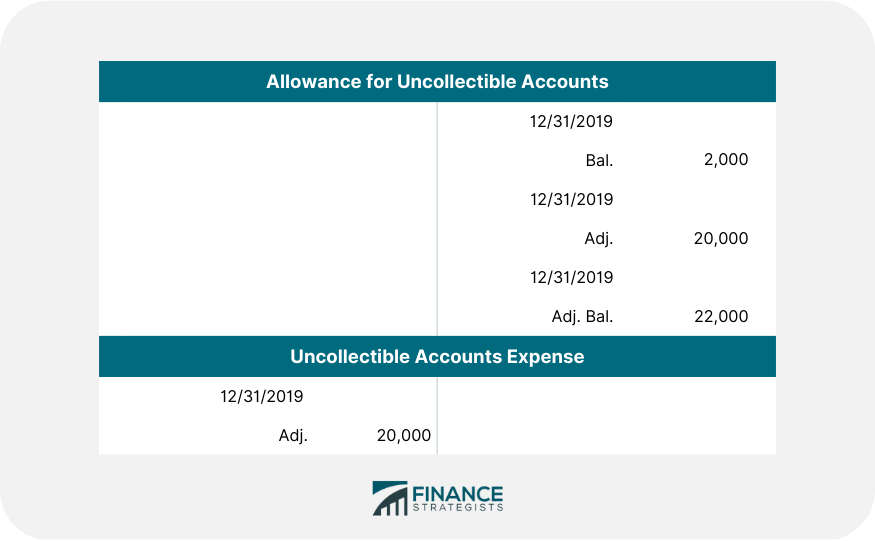

Percentage of Net Sales is a method of estimating uncollectible accounts expense under which the amount of uncollectible accounts expense is determined by the analysis of the relationship between net credit sales and the prior year’s uncollectible accounts expense. The percentage-of-net-sales method determines the amount of uncollectible accounts expense by analyzing the relationship between net credit sales and the prior year’s uncollectible accounts expense. This method is often referred to as the income statement approach because the accountant attempts, as accurately as possible, to measure the expense account Uncollectible Accounts. As we will see later the balance in the Allowance for Uncollectible Accounts is simply a result of the entry to record the estimated uncollectible accounts expense for the period. To demonstrate the application of the percentage-of-net-sales method, assume that you have gathered the following data, prior to any adjusting entries, for the Porter Company at the end of 2019. This assumes that all accounts determined to be uncollectible have already been written off against Accounts Receivable and the Allowance account. The management of the Porter Company has analyzed the relationship of the prior year’s losses from uncollectible accounts and net credit sales for the last five years and feels that uncollectible accounts expense will be approximately 2% of credit sales. This analysis, based on five years’ prior data, is as follows: Based on this data, the debit to the uncollectible accounts expense is 2% of net credit sales of $1 million, or $20,000. The correct adjusting entry at December 31, 2019 to record this estimate is: After this entry is posted, the relevant T accounts appear as follows: The balance in the Uncollectible Accounts Expense represents 2% of net credit sales. The balance in this account will always be a function of a predetermined percentage of credit sales when the net-sales method is used. The balance in the Allowance for Uncollectible Accounts Expense is @22,000 – $2,000 from the prior year’s sales that have not yet been determined uncollectible and $20,000 from 2019 sales. At the end of any particular year, the credit balance in this account will fluctuate, but only by coincidence will it be equal to the debit balance in the account Uncollectible Accounts Expense.What Is the Percentage of the Net Sales Method? – Definition

Explanation

Percentage of Net Sales Method FAQs

The Percentage of Net Sales Method is an inventory valuation and cost flow assumption method that assigns a value to end inventories and the cost of goods sold based on the percentage of net sales realized from those items during the period.

The Percentage of Net Sales Method works by assigning a cost to each item in the ending inventory equal to the percentage of net sales realized from that item during the period. When an item is sold, it is given a cost equal to its assigned percentage multiplied by the total net sales for that period.

The primary advantage of using the Percentage of Net Sales Method is that it simplifies inventory costing and provides a more accurate picture of inventory value than other methods, such as average cost or last in first out (LIFO). It also allows for more accurate financial reporting and tax compliance.

The downside to using the Percentage of Net Sales Method is that it can be subject to manipulation if sales figures are not properly monitored or reported accurately. Additionally, it does not take into account changes in inventory costs over time or fluctuations in the demand for certain products.

Best practices when using the Percentage of Net Sales Method include regularly monitoring sales figures and inventory levels to ensure accurate reporting and compliance with tax regulations. It is also important to establish controls and procedures to prevent the manipulation of sales figures. Additionally, it is recommended that companies periodically review their inventory costing methods to ensure that the Percentage of Net Sales Method continues to be the most appropriate for their needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.