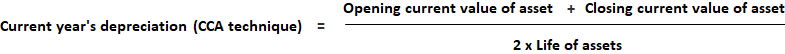

In Current Cost Accounting (CCA), assets are shown in the balance sheet at the current replacement costs after allowing for depreciation. This also requires an adjustment for depreciation. Use the following formula to calculate the current year's depreciation under CCA

To calculate the depreciation adjustment, the following formula can be used: Depreciation adjustment = Current year's depreciation on CCA - Depreciation on historical cost A machine was purchased on 1 January 2019 at a cost of $1,000,000. Its useful life was estimated at 10 years. The machine's replacement cost was $180,000 on 1 January 2024 and $2,000,000 on 31 December 2024. Calculate the depreciation adjustment. Current year's depreciation (CCA method) = (180,000 + 2,000,000) / (2 x 10) = $190,000 Historical depreciation = 1,000,000 / 10 = $100,000 Depreciation adjustment = Current year's depreciation on CCA - Historical depreciation = 190,000 - 100,000 = $90,0000Formula

Example

Solution

Calculation of Depreciation Adjustment Under the Current Cost Accounting Technique FAQs

This is how it works: book value = (original cost – accumulated Depreciation) x (remaining useful life / estimated useful life) Depreciation adjustment = book value – historical book value = original cost – accumulation of Depreciation

The Depreciation adjustment will be the historical cost - accumulated Depreciation.

Depreciation refers to the value lost by a certain good over a period of time due to wear and tear. It can also be called a diminution in value.

Depreciation adjustment is used while calculating Depreciation under the current Cost Accounting technique.

It stands for current Cost Accounting, which records assets at their replacement costs after allowing for Depreciation. Replacing assets would include buying new assets or refurbishing old ones.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.