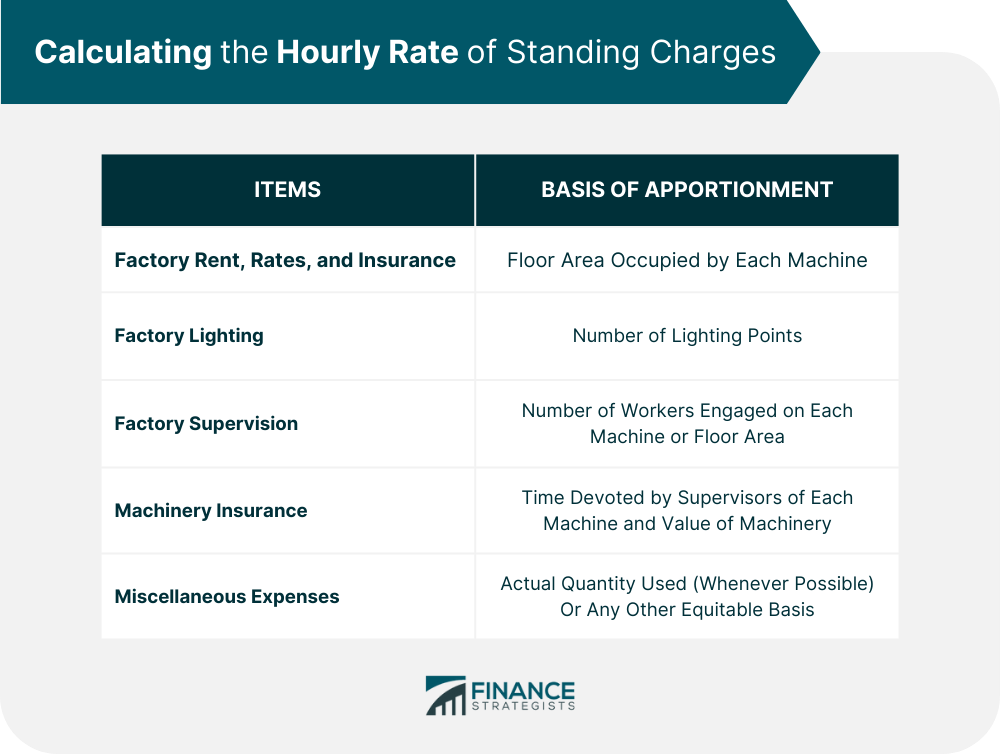

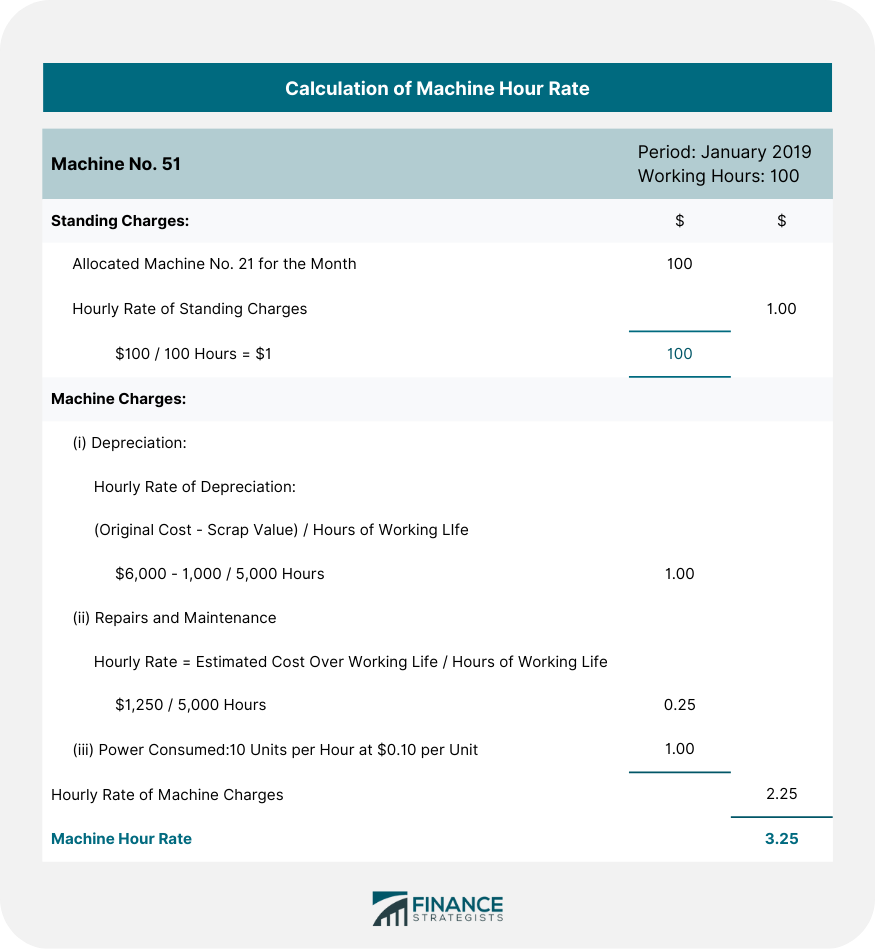

A machine hour rate is the hourly cost in terms of factory overheads to operate a particular machine. It is obtained by dividing the factory expenses associated with the machine for a given period by the number of hours worked by the machine during that period. In Thothadri, Nafeesa, and Jalalutheen's seminal 2019 book entitled Cost Accounting, the machine hour rate is defined as follows: The machine hour rate is computed to recover or absorb factory overheads. This basis for the recovery of overheads is adopted in industrial concerns where most of the work is driven by machines. In these companies, most of the factory expenses result from machine operations. To compute the machine hour rate, each machine or a group of similar machines in a production department is considered a smaller department, and departmental expenses are re-apportioned to the machines or groups of machines in the department. To this end, the following fundamental factors should be considered: A base period is taken for every machine to compute the machine hour rate. This base period is the period for which the hourly rate is to be computed (it may be a year, quarter, month, or week). The number of normal or standard working hours of each machine in the base period has to be estimated. The departmental expenses to be considered when calculating the machine hour rate are divided into two parts: Standing charges include all the expenses that remain fixed or constant, and which relate to the department as a whole. These are not affected by the operation of the machines. Examples of standing charges include rent, rates, and insurance for the factory building, the cost of factory supervision, factory lighting, and machine insurance. Running charges include the expenses that are incurred in connection with the operation of the machines (e.g., depreciation, repairs, and maintenance, as well as power, steam, and water use charges). To compute the machine hour rate, all standing charges relating to the production department are apportioned to the individual machines on the following bases: The standing charges are taken for the base period. To obtain the hourly rate of standing charges, the total of the standing charges apportioned to each machine for the base period is divided by the total working hours of the machine during the base period. The hourly rate of various items of machine charges (or running charges) is calculated separately in the following way: (a) Depreciation To calculate the hourly rate of depreciation for a machine, the following information must be available: Using this information, the hourly rate of depreciation of the machine can be calculated by applying the following formula: Hourly rate of depreciation = (Original cost of machine — Estimated scrap value) / Effective working life of machine in terms of running hours (b) Repairs and Maintenance Generally, the cost of repairs and maintenance for a machine over its effective working life is estimated based on previous experience. The hourly rate of repairs and maintenance can be ascertained using the following formula: Hourly rate of repairs and maintenance = Estimated cost of repairs and maintenance over the life of the machine / Effective working life of machine in terms of running hours (c) Power, Steam, and Water The hourly cost of power, steam, and water consumed is ascertained based on either of the following: The hourly rates of standing charges and running charges will be aggregated to obtain the machine hour rate. From the following information, compute the machine hour rate for Machine No. 51 for the month of January 2019:What Is Machine Hour Rate?

An actual or pre-determined rate of cost apportionment or overhead absorption which is calculated by dividing the cost to be apportioned or absorbed by the number of hours for which a machine or machines are operated or expected to be operated.

Why Calculate the Machine Hour Rate?

(i) Base Period

(ii) Normal Hours of Working

(iii) Distribution of Expenses

Standing Charges

Running Charges

(iv) Calculating the Hourly Rate of Standing Charges

(v) Calculating the Hourly Rate of Machine Charges

Example

Solution

Calculating the Machine Hour Rate FAQs

A machine hour rate is the hourly cost in terms of factory overheads to operate a particular machine. It is obtained by dividing the factory expenses associated with the machine for a given period by the number of hours worked by the machine during that period.

The machine hour rate is computed to recover or absorb factory overheads. This basis for the recovery of overheads is adopted in industrial concerns where most of the work is driven by machines. In these companies, most of the factory expenses result from machine operations.

The machine hour rate is calculated by aggregating the hourly rates of standing charges and running charges. The total of these rates is then divided by the total number of hours worked by the machine during the base period.

The calculation of the machine hour rate includes depreciation, repairs and maintenance, power, steam, and water use charges, factory rent, rates, and insurance, factory lighting, factory supervision, and machinery insurance.

The machine hour rate is used to determine the cost of running a machine for a certain period of time. It is also used to compare the cost of running different machines. Additionally, the machine hour rate can be used to make decisions about whether to rent or purchase a machine.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.