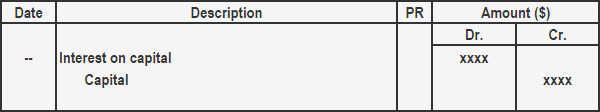

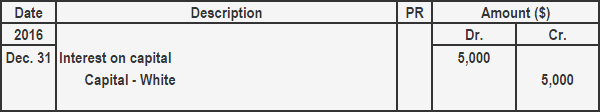

A business owner may regard their capital as an investment on which they should receive interest. Interest at a normal rate is calculated on owner's capital and is charged to the income statement (or profit and loss account) for the purpose of ascertaining what extra income is derived from the business over and above the usual rate of interest on capital employed. The capital invested in the business is treated as a loan granted to the business. The amount of interest charged on capital is an indirect expense of the business, and on the other hand, it is a form of income for the owner. Interest on capital has the following two effects on final accounts: Interest on capital is an expense to business. To record it, make the following adjusting entry: Mr. White's capital balance was $50,000 on 1 January 2016. Interest is allowed on capital at the rate of 10%. Required: Make adjusting entries for 31 December 2016. On 31 December 2016, the following adjusting entry will be made to record interest on Mr. White's capital: Note: Interest on capital amounts to $50,000 × 0.1 = $5,000.Accounting Treatment

Adjusting Entries

Example

Solution

Adjusting Entry for Interest on Capital FAQs

The purpose of an adjusting entry for interest on capital is to record the amount of interest that has accrued on the company's outstanding loans and investments. This information is used in financial reporting to provide a more accurate picture of the company's financial position.

Interest on capital is calculated by taking into account the outstanding balance of the loan or investment, the current interest rate, and the length of time that the loan or investment has been outstanding.

No, not immediately. Interest on capital will be included in profit and loss account (or income statement). It will be recorded and debited at a later date, when and if, interest is paid to the lenders.

Some common reasons for why a company would need to make an adjusting entry for interest on capital include:-The company has outstanding loans that are accruing interest.-The company has investments that are earning interest.-The company needs to provide a more accurate picture of its financial position for financial reporting purposes.

If a company does not make an adjusting entry for interest on capital, it will understate its liabilities and overstate its assets on its balance sheet. This can give investors and creditors a false impression of the company's financial health, which could lead to them being less willing or willing to invest in or lend money to the company. Additionally, failing to properly record interest on capital can result in the company paying taxes on money that it has not actually earned, which can put the company at a financial disadvantage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.