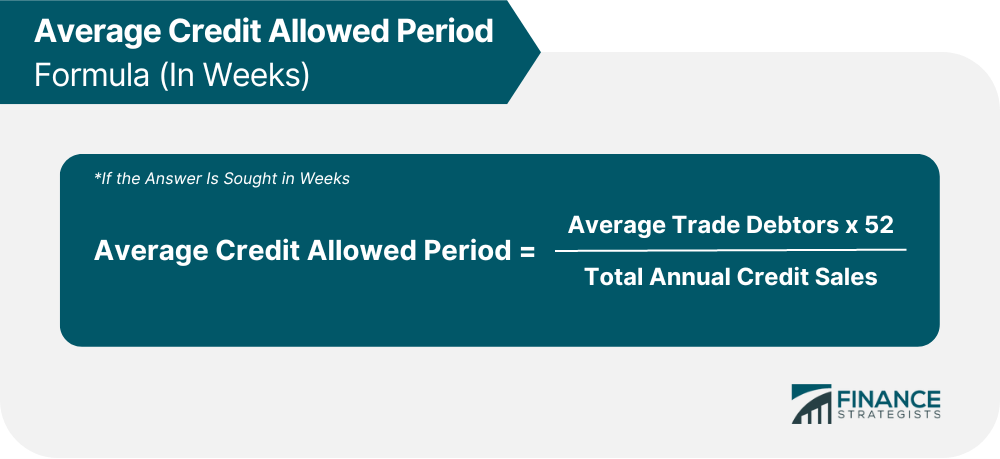

The average credit allowed period is another way of stating the debtors turnover ratio. It is calculated in terms of the number of weeks (or months) taken by each debtor—on average—to pay off their debt to the company. As you might expect, if the rate of debtors turnover is high, the average credit allowed period will be low. Conversely, if the rate of debtors turnover is low, this indicates a high average credit allowed period. If the average credit allowed period is high, the company not only has to incur additional financial charges to finance this credit, but it also runs the risk of having high bad debts and a high cost of maintaining debtors records and following up. Each type of industry has a specific average credit allowed period that each company in the industry should try to stay close to (or, hopefully, surpass). In fact, in times of interest rates and low productivity, having a very long credit allowed period may expose a company to substantial losses. Effective credit control should be exercised to bring down this period to the lowest possible level. The average credit allowed period is calculated as follows (if the answer is sought in weeks): Also, for an answer in months, the average credit allowed period is calculated as follows:

Average Credit Allowed Period FAQs

The average credit allowed period is calculated by dividing the total number of debtor days by 365.

Credit allowed refers to the time within which a company expects its debtors to settle their debts with them. The credit or length of credit offered varies from company to company and from industry to industry.

A debtor is a firm or an individual who has borrowed money from, or purchased goods on credit terms, from a particular business. The term covers both individual debtors and companies. A debtor's turnover period refers to the number of days it takes on average to collect money from its debtors.

Debtor's turnover period is calculated by dividing the total number of days sales outstanding (DSO) by 365 and multiplying the result by 100. The DSO can be found at year end in an income statement or balance sheet.

To calculate average credit allowed, divide total debtor days by 365.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.