A cash book with three columns for discounts received and paid, cash transactions, and bank transactions is known as a three column cash book. A three column cash book, also known as a triple column cash book, contains three money columns on both the debit and credit sides: one on each side for recording discount, cash, and bank amounts. If a business holds a bank account frequently makes receipts and payments through that bank account, then it is useful to maintain a three column cash book rather than a single or double column cash book. It is customary for businesses to allow discounts for early payments. For example, if cash is paid early, creditors may receive a discount. On the other hand, if debtors pay early, a discount may be allowed to them. You may remember that cash and discounts are closely related. This is the reason why discount columns are also provided in the cash book. In a three column cash book, three columns are provided for the amounts on each side. One column records cash receipts and payments, the second records banking transactions, and the third records discounts received and allowed. Although single and double column cash books are alternatives to a cash account, the three column cash book serves the purpose of cash as well as a bank account. Consider the following critical aspects of discount columns in a triple column cash book: The common format used in a three column cash book is shown below. It is worth mentioning that the format of a three column cash book is similar to that of a two column cash book. The only exception is that a column is added in a three column cash book to account for bank-related transactions. If you are ever recording entries in a three column cash book, this section presents a few key points you should bear in mind. The opening balance of cash in hand and cash at the bank are recorded on the debit side in the cash and bank columns, respectively. If the bank balance is a credit balance (overdraft), then it is entered on the credit side in the bank column. If a cheque is received and deposited into a bank account on the same date, it will appear on the debit side on the cash book in the bank column. If the cheque is not deposited into a bank account on the same date, it is treated as cash and, therefore, the amount will appear in cash column. Finally, in the usual manner, the receipt of cash is recorded in the cash column. If a payment is made by cheque, it will be recorded on the credit side in the bank column. This is because the cash at bank has decreased. If the payment is made in cash, it will be recorded in the cash column in the usual manner. Bank charges are recorded on the credit side of the cash book in the bank column. This is because cash at bank decreases as a result of such charges. If an entry is made on the debit side and the same entry is recorded on the credit side of the cash book, it is called a contra entry. To differentiate contra entries from other entries, letter "C" is printed in the posting reference column (on both the debit and credit sides of the cash book). The letter "C" indicates that the contra effect of this transaction is recorded on the opposite side. Contra entries may be one of the following types: When cash is deposited into a bank, two entries are required: one on the credit (payment) side in the cash column, which records the reduction in cash in hand; and the other on the debit (receipt) side in the bank column, which records the increase in cash at bank. When cash is withdrawn from a bank for office use, two entries are needed: one on the credit side in the bank column, which records the reduction of cash at bank; and the other on the debit side in the cash column, which records the increase in cash in hand. It has already been explained that when a cheque is received and not deposited into a bank on the same date, the amount will be recorded on the debit side of the cash book in the cash column. When the same cheque is deposited into a bank account on another date, two entries are required: one on the debit side in the bank column, which records the increase in the amount at bank; and the other on the credit side in the cash column, which records the cash (cheque) paid into the bank. Whenever it is necessary to determine the bank balance, the bank columns are summed on both sides. If the debit column is larger than the credit column, the difference represents cash at bank. If, on the other hand, the credit column exceeds the debit column, the difference represents "overdrawn balance". A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited. The cash columns are balanced as usual. The discount columns are simply summed and not balanced. An overview of this procedure is given on the double column cash book page. The method of posting a three column cash book into ledger is as follows: During May 2016, the John Trading Company made the following transactions:What is a Three Column Cash Book?

Explanation

Discount Columns: Key Points

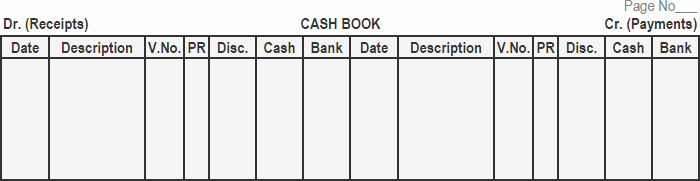

Format of a Three Column Cash Book

Hints for Record Keeping in a Three Column Cash Book

Opening Balance

Receipt of Cheque or Cash

Payment by Cheque or Cash

Bank Charges

Contra Entries: Definition

Balancing the Three Column Cash Book

Posting Three Column Cash Book to Ledger Accounts

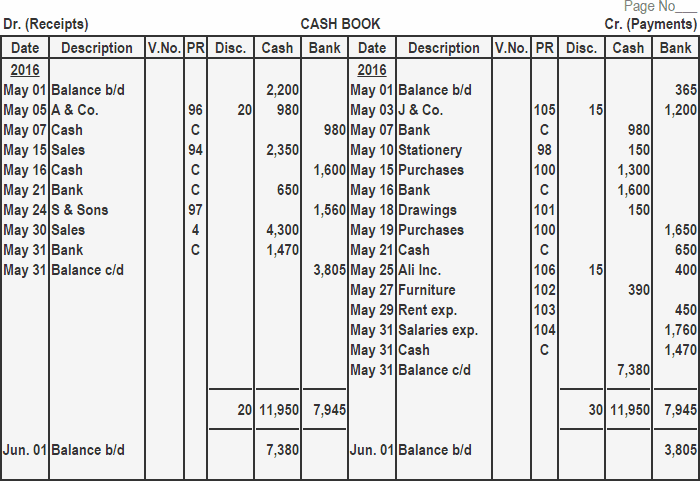

Example

Solution

Cash Book Exercises

Three Column Cash Book FAQs

A cash book with three columns for discounts received and paid, cash transactions, and bank transactions is known as a three column cash book.

1. The opening balances of the cash book are not posted. 2. Contra entries are not posted because the double entry accounting for these transactions is completed within the cash book. 3. All items on the debit side of the cash book are posted to the credit of respective accounts in the ledger. 4. All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger. 5. The total of the discount column on the debit side is posted to the debit of discount allowed account, and the total of the discount column on the credit side is posted to the credit of discount received account in the ledger.

A contra entry is when an entry is made on the debit side and the same entry is recorded on the credit side of the cash book.

The difference between the two types of cash book is that a double cash book has two money columns (cash and bank) whereas a triple column cash book has three money columns (cash, bank and discount).

Three column cash book records three types of accounts, i.e., cash, bank and discount. This substitutes the creation of cash account, bank account, discount received and discount allowed in the ledger.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.