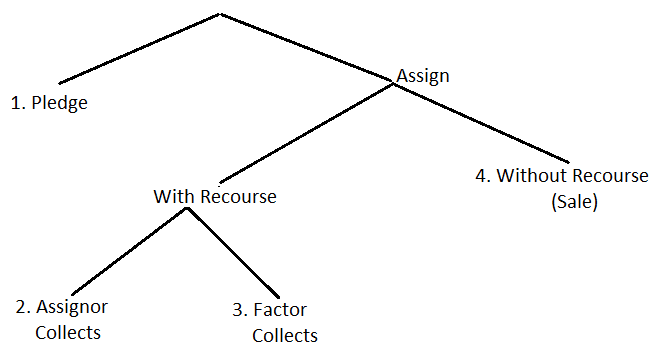

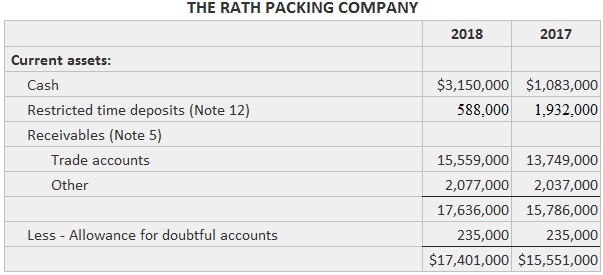

Often in real life, a company's management will decide that it would rather have cash immediately than wait for receivables to be collected. There are two broad approaches to generating cash from receivables. In one, the receivables are pledged as collateral for a loan. In the other, the receivables are assigned to another party (a factor), much in the same sense that other assets are sold. However, there are characteristics of these assignments that prevent some of them from being exactly like a sale. The illustration below summarizes the four possible methods: The use of non-uniform terms in practice makes it even more difficult to understand these practices. The meaning of pledging is generally unambiguous and, therefore, there is no problem. However, many persons refer to the act of assigning as factoring. Some have even used assignment to refer to situations in which accounts are assigned with recourse while using factoring to refer to situations where there is no recourse. We have chosen the approach in this category for its descriptiveness, simplicity, and similarity to legal usage. We encourage the reader to understand the concept of each approach. Then, when these situations are encountered in practice, they will be accounted for according to their nature rather than the terminology used. This example demonstrates disclosures when receivables are used to generate cash. Consider the following information about the Rath Packing Company's current assets: NOTE 5: Financing Agreement All receivables and inventories have been pledged as collateral for borrowings under a financing agreement. The lender is a commercial finance company; however, two banks participated in the borrowings up to a maximum amount of $4,000,000 until 3 September 2018. One of the banks has continued to participate up to a maximum amount of $2,000,000 since that date. The total amount available for borrowing under the agreement varies as determined by the commercial finance company. It amounted to $10,000,000 on 27 September 2018.

Example

Using Receivables to Generate Cash FAQs

Accounts Receivable (A/R) refers to the outstanding invoices a company has issued to its customers for products or services sold, but which have not yet been paid. This represents the money that a company is owed by its customers for goods or services that have been delivered but not yet paid for.

There are four basic methods: (1) pledge accounts receivable as collateral for a loan; (2) assign accounts receivable with recourse, also known as factoring; (3) assign accounts receivable without recourse, and (4) use accounts receivable as collateral for a standby letter of credit.

There are several benefits to using receivables to generate cash. First, it can help improve a company's cash flow situation by increasing the amount of money coming in. Second, it can help a company better manage its working capital, as it can use the cash generated from receivables to pay down other debts or invest in new inventory. Finally, using receivables to generate cash can help a company build stronger relationships with its customers, as they will see that the company is willing to work with them to get paid.

There are a number of risks associated with using receivables to generate cash. The most obvious risk is that a company may not be able to collect all of the money it is owed. This could significantly reduce or even eliminate the benefits of using receivables to generate cash. Additionally, a company that relies too much on receivables to generate cash may end up taking on too much risk, which could lead to financial problems down the road.

There are a few things a company can do to maximize the benefits and minimize the risks of using receivables to generate cash. First, it is important to have a solid understanding of one's customers and their payment habits. This will help a company better assess which receivables are most likely to be paid on time and which ones are more likely to go unpaid. Second, a company should have strong internal controls in place to ensure that all receivables are properly managed and collected. Finally, a company should consider using a third-party service to help manage its receivables and collection efforts. This can take some of the burdens off of the company and help improve its chances of successful collections.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.