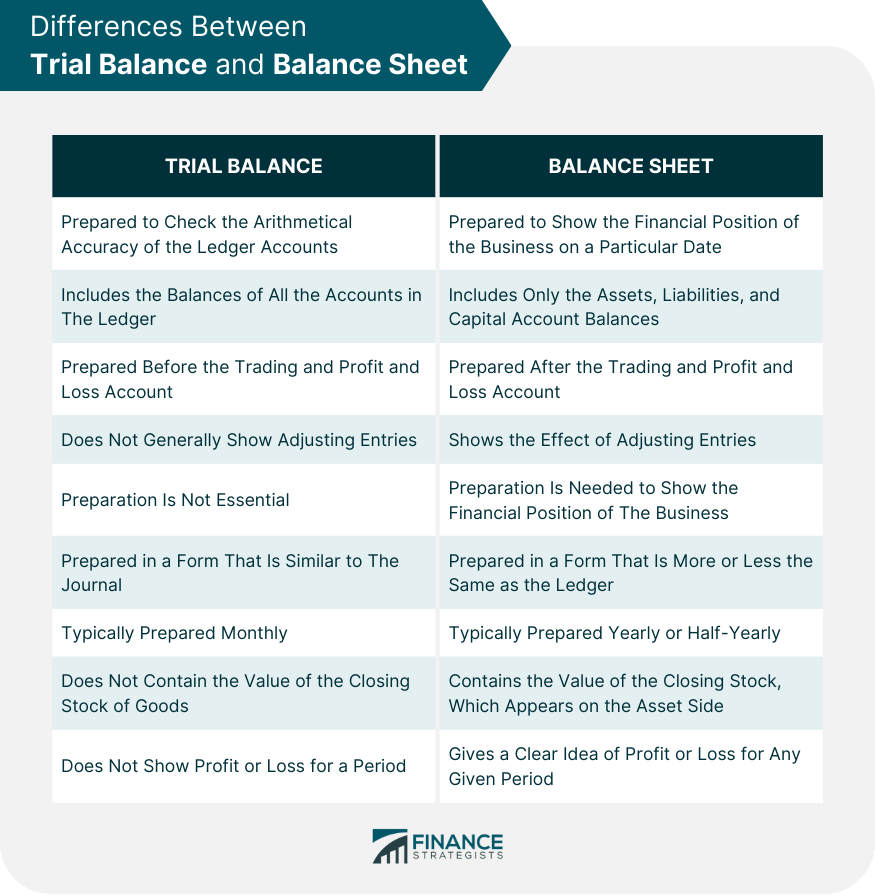

The following table summarizes the main differences between the trial balance and balance sheet.

Difference Between Trial Balance and Balance Sheet FAQs

A Trial Balance is the preparation of all accounts from ledger card notes and prepared in ascending order. In other words, it consist of debit or credit side.

A balance sheet is prepared at the end of financial year to ascertain the financial position of an organization.

A Trial Balance is not necessary if the accounts are checked for accuracy and found in order. If we find any error we will rectify it at that time rather than preparing a Trial Balance and then rectifying it during auditing process. Auditors may insist on Trial Balance because that is the only way they can know about the arithmetical errors if any.

Balance sheet is prepared at the end of financial year to ascertain the financial position of an organization. It consists of assets, liabilities and capital account balances.

Debits are the side of an account which shows the increase in assets, decrease in liabilities and capital. Credits means opposite i.E., Decrease in assets, increase in liabilities or capital accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.