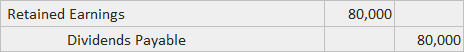

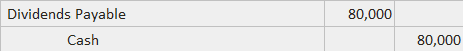

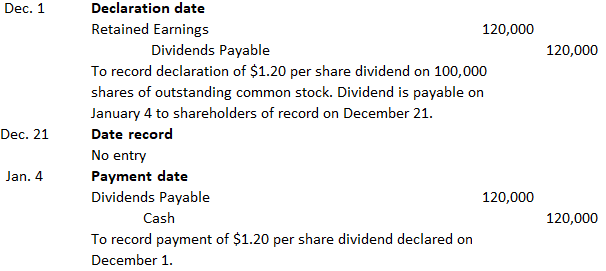

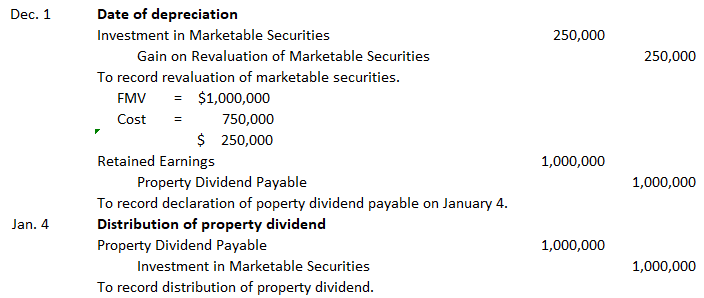

A cash dividend is a payment made by a company, using its earnings, to its shareholders in the form of cash. Most investors purchase either common or preferred stock with the expectation of receiving cash dividends. The amount and regularity of cash dividends are two of the factors that affect the market price of a firm's stock. Many corporations, therefore, attempt to establish a quarterly dividend pattern that is maintained or slowly increased over a number of years. In profitable years, the corporation may issue a special year-end dividend in addition to regular dividends. Stable dividend policies of this kind typically increase the attractiveness of a firm's stock. The following, taken from a General Electric Company annual report, shows how one corporation implements this policy: In addition to the desire to maintain a stable dividend policy, other factors also affect the amount of cash dividends declared in any one year (e.g., the amount of retained earnings, the firm's cash position, and business needs). From a theoretical and practical point of view, there must be a positive balance in retained earnings in order to issue a dividend. If there is a deficit (negative balance) in retained earnings, any dividend would represent a return of invested capital. Dividends of this kind are known as liquidating dividends. A corporation can still issue a normal dividend (a dividend other than a liquidating one) even if it incurs a loss in any one particular year. This can be done as long as there is a positive balance in retained earnings. Because there must be a positive balance in retained earnings before a normal dividend can be issued, the phrase "paying dividends out of retained earnings" began to be commonly used. However, this phrase is a misstatement. In fact, dividends are not paid out of retained earnings; they are a distribution of assets and are paid in cash or, in some circumstances, in other assets or even stock. Retained earnings are the increase in the firm's net assets due to profitable operations and represent the owners' claim against net assets, not just cash. The maximum amount of dividends that can be issued in any one year is the total amount of retained earnings. However, this is rarely, if ever, done. Again, in order to pay a cash dividend, a firm must have the necessary cash available, and the amount of cash on hand is not directly related to retained earnings. Furthermore, as is evident from the statement in the General Electric Company annual report, a firm has other uses for its cash. Most mature and stable firms restrict their cash dividends to about 40% of their net earnings. Returning to the General Electric Company example, the company paid dividends of $852 million in 1983, which represented 42% of its net income. All dividends must be declared by the board of directors before they become a liability of the corporation. There are three dates that are significant to the declaration and payment of dividends: The declaration date is the date on which the board of directors declares the dividend. It is at that time that the dividend becomes a liability of the corporation and is recorded in its books. The declaration date is usually several weeks prior to the payment date. A typical dividend announcement is shown as follows: Only stockholders as of the date of record are eligible for the dividend. Given the time involved in compiling the list of stockholders at any one date, the date of record is usually two to three weeks after the declaration date, but it comes before the actual payment date. The payment date is the date that the dividend is actually paid. It usually occurs around one month after the declaration date. When a cash dividend is declared, the board of directors specifies an amount that is to be paid per share to stockholders as of specified record date on a specified payment date. On the date of declaration of a total dividend of $80,000, the following journal entry would be recorded: Alternatively, some accountants prefer to debit the temporary account known as Dividends Declared, which is closed to Retained Earnings at year-end. On the payment date, the following journal entry would be made: Many larger firms use a special checking account to disburse cash dividends. To demonstrate the journal entries required when a cash dividend is declared and paid, let's return to the above example. Specifically, a company's board of directors has declared a $1.20 per-share dividend on 1 December payable on 4 January to the common shareholders of record on 21 December. Since there are 100,000 common shares outstanding, the total cash dividends will be $120,000. When recording the declaration of a dividend, some firms debit an account entitled Dividends Declared instead of debiting Retained Earnings. There is nothing wrong with this procedure, except that a closing entry must be made to close the Dividends Declared account into Retained Earnings. As a result of this entry, the ultimate effect is to reduce retained earnings by the amount of the dividend. Occasionally, a firm will issue a dividend in which the payment is in an asset other than cash. Non-cash dividends, which are called property dividends, are more likely to occur in private corporations than in publicly held ones. Under current accounting practices, non-cash dividends are revalued to their current market value and a gain or loss is recognized on the disposition of the asset. To illustrate, assume that Ironside Corporation declared a property dividend on 1 December to be distributed on 4 January. Marketable securities held by the firm with a cost of $750,000 and a fair market value of $1 million are to be distributed to the shareholders. The journal entries to reflect these transactions are:Cash Dividend: Definition

Cash Dividend: Explanation

Dividends declared in 1983 were $852 million. This was $1.875 per share, up 12% from 1982, and marked the eighth consecutive year in which dividends were increased.

It is General Electric's policy to maintain a reasonable dividend rate while at the same time retaining enough earnings to enhance productive capacity and to allocate financial resources to earnings growth opportunities

As this excerpt indicates, the management at General Electric Company has given considerable thought to the amount and timing of dividends.Declaring Dividends

The board of directors on 1 December declared a dividend of $1.20 per share payable on 4 January to common shareholders of record on 21 December.

Journal Entries to Record Cash Dividend

Non-Cash Dividends

Cash Dividend FAQs

A cash dividend is a payment made by a company, using its earnings, to its shareholders in the form of cash. Most investors purchase either common or preferred stock with the expectation of receiving cash dividends.

The declaration date is when the board of directors declares the dividend. It is at that time that the dividend becomes a liability of the corporation and is recorded in its books. It is usually several weeks prior to the payment date.

The payment date is when the cash dividend is actually paid. It usually occurs around one month after the declaration date.

The number of shares and per share value affects the amount of dividends. If there are more shares, then less money is distributed per share, and vice versa if there fewer shares outstanding.

The record date is when the shareholder must be on the corporation's records as owning stock. It is usually two to three weeks after the declaration date, but it comes before the payment date.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.