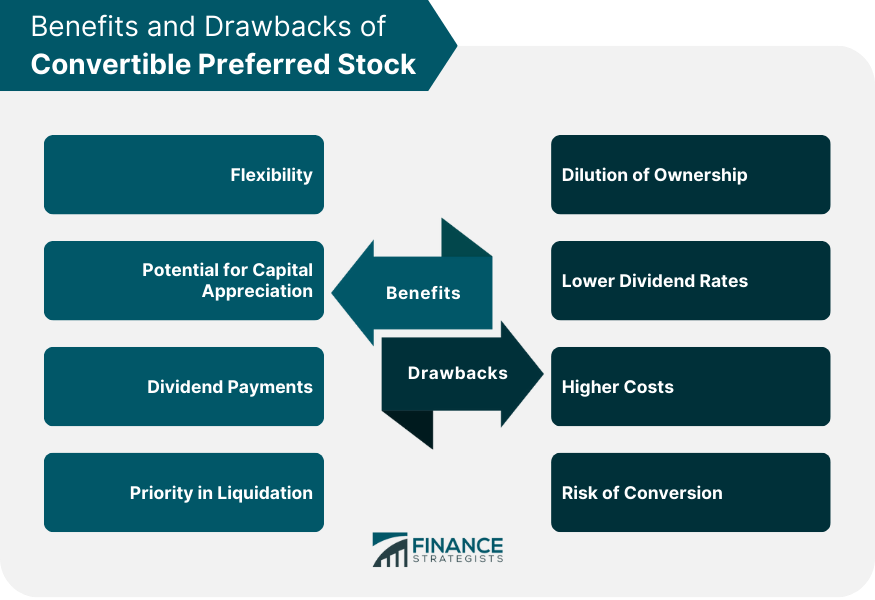

Convertible preferred stock is a hybrid security that combines features of both common stocks and bonds. It is a type of stock that can be converted into a predetermined number of common shares at the discretion of the holder or the issuer. This means that investors have the option to convert their preferred shares into common stock at a specified price and at a specific time. Convertible preferred stock has several characteristics that make it an attractive investment opportunity. These features include the potential for capital appreciation, higher dividend payments, and priority in liquidation. However, there are also some drawbacks associated with convertible preferred stock, such as dilution of ownership and lower dividend rates. Mandatory convertible preferred stock is a type of preferred stock that requires the holder to convert their shares into common stock at a specified time. This means that the holder has no choice but to convert their shares into common stock at the conversion date, which is usually predetermined by the issuer. Mandatory convertible preferred stock is often used by companies to raise capital because it allows them to issue equity without diluting their ownership or control. It also provides investors with the opportunity to earn higher returns by investing in a security that has the potential to appreciate in value. Voluntary convertible preferred stock is a type of preferred stock that gives the holder the option to convert their shares into common stock at any time before the conversion date. This means that the holder has the flexibility to choose whether or not to convert their shares into common stock based on market conditions or their own investment strategy. Voluntary convertible preferred stock is often preferred by investors who want the flexibility to convert their shares into common stock when they believe it is most advantageous. It also allows companies to raise capital without diluting their ownership or control, while also providing investors with the potential for higher returns. Participating convertible preferred stock is a type of preferred stock that allows the holder to participate in the company's profits on a pro-rata basis with common shareholders. This means that if the company distributes dividends to common shareholders, holders of participating convertible preferred stock will also receive a share of the dividends based on the number of shares they hold. Participating convertible preferred stock is often preferred by investors who want to earn a higher return on their investment through dividends. It is also beneficial for companies because it allows them to raise capital without diluting their ownership or control, while also providing investors with the potential for higher returns. Non-participating convertible preferred stock is a type of preferred stock that does not allow the holder to participate in the company's profits on a pro-rata basis with common shareholders. This means that if the company distributes dividends to common shareholders, holders of non-participating convertible preferred stock will not receive a share of the dividends. Non-participating convertible preferred stock is often preferred by investors who are more interested in the potential for capital appreciation than in earning dividends. It is also beneficial for companies because it allows them to raise capital without diluting their ownership or control. Callable convertible preferred stock is a type of preferred stock that allows the issuer to call back or redeem the stock at a specified price and time. The issuer has the option to force the holder to sell their shares back to the issuer at a predetermined price before the maturity date. Callable convertible preferred stock is often used by companies that want to raise capital quickly without diluting their ownership or control. It also provides investors with the potential for higher returns, but they may have to sell their shares back to the issuer at a specified time. Convertible preferred stock offers investors flexibility because it can be converted into common stock at any time. This means that investors have the option to convert their shares into common stock when it is most advantageous to them. For example, if the company's common stock is expected to appreciate in value, investors can convert their preferred shares into common stock to benefit from the potential increase in value. Convertible preferred stock offers investors the potential for capital appreciation. If the company's common stock appreciates in value, the value of the convertible preferred stock also increases. This means that investors can earn a higher return on their investment if the company's stock performs well. Convertible preferred stock offers investors higher dividend payments than common stock. This is because the company is required to pay dividends on preferred shares before paying dividends on common shares. This means that investors who hold convertible preferred stock can earn a higher return on their investment through dividend payments. Convertible preferred stockholders have priority over common stockholders in the event of a company's liquidation. This means that if the company is liquidated, preferred stockholders will be paid first before common stockholders. This provides an added layer of protection for investors who hold convertible preferred stock. Convertible preferred stock can dilute the ownership of common stockholders. This is because when the preferred stock is converted into common stock, the number of outstanding shares increases. This means that the existing common stockholders' ownership percentage decreases. While convertible preferred stock offers higher dividend payments than common stock, it also has lower dividend rates than bonds. This is because preferred stock is considered to be a riskier investment than bonds, which means that investors demand a higher return on their investment. Convertible preferred stock is often more expensive to issue than common stock or bonds. This is because it has more complex features, such as the conversion option, which requires additional legal and accounting work to create and administer. Convertible preferred stock carries the risk that it may not be converted into common stock. This means that if the company's common stock does not perform well, the value of the preferred stock may not increase. This can lead to lower returns on investment for the investor. The conversion ratio is the number of common shares that can be obtained for each preferred share that is converted. This ratio is usually predetermined by the company when it issues the convertible preferred stock. The conversion price is the price at which the preferred stock can be converted into common stock. This price is also predetermined by the company when it issues the convertible preferred stock. The conversion premium is the amount by which the market price of the convertible preferred stock exceeds its conversion price. This premium represents the value that investors place on the option to convert the preferred stock into common stock. Convertible preferred stock is a hybrid security that combines features of both common stocks and bonds. It allows investors the option to convert their preferred shares into common stock at a specified price and time. Convertible preferred stock has several characteristics that make it an attractive investment opportunity, such as potential for capital appreciation, higher dividend payments, and priority in liquidation. The benefits of convertible preferred stock include flexibility, potential for capital appreciation, dividend payments, and priority in liquidation. However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion. Convertible preferred stock can be a valuable investment opportunity for investors who want to balance risk and reward. However, investors should carefully consider the benefits and drawbacks of convertible preferred stock before investing, and companies should carefully consider the costs and benefits of issuing convertible preferred stock before deciding to do so. What Is Convertible Preferred Stock?

Types of Convertible Preferred Stock

Mandatory Convertible Preferred Stock

Voluntary Convertible Preferred Stock

Participating Convertible Preferred Stock

Non-participating Convertible Preferred Stock

Callable Convertible Preferred Stock

Benefits of Convertible Preferred Stock

Flexibility

Potential for Capital Appreciation

Dividend Payments

Priority in Liquidation

Drawbacks of Convertible Preferred Stock

Dilution of Ownership

Lower Dividend Rates

Higher Costs

Risk of Conversion

Factors Affecting the Conversion Process of Convertible Preferred Stock

Conversion Ratio

Conversion Price

Conversion Premium

Conclusion

Convertible Preferred Stock FAQs

Convertible preferred stock is a type of stock that can be converted into a predetermined number of common shares at a specific time and price.

Convertible preferred stock offers benefits such as flexibility, potential for capital appreciation, dividend payments, and priority in liquidation.

The drawbacks of convertible preferred stock include dilution of ownership, lower dividend rates, higher costs, and risk of conversion.

The conversion process of convertible preferred stock involves a conversion ratio, conversion price, and conversion premium.

The types of convertible preferred stock include mandatory, voluntary, participating, non-participating, callable, puttable, fixed-rate, floating-rate, adjustable-rate, reverse, and exchangeable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.