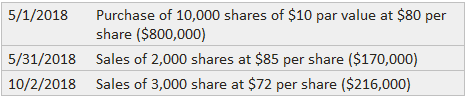

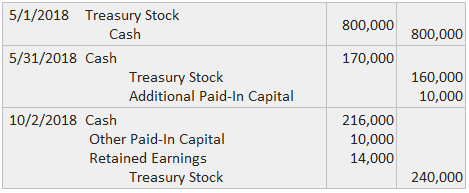

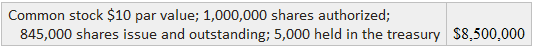

The cost method is based on the assumption that the acquisition of treasury stock is essentially a temporary reduction in stockholders' equity that will be reversed when the shares are reissued. It is widely used due to its simplicity. When shares are acquired, the Treasury Stock account is debited and the Cash account is credited. When the shares are reissued, Cash is debited for the proceeds and Treasury Stock is credited for the amount paid out originally. In the event that the proceeds exceed the original cost, the Additional Paid-In Capital account should be credited. If the proceeds are less than the original cost, Additional Paid-In Capital should be debited. For the following example entries, these facts are assumed: The journal entries would be recorded as follows: The Treasury Stock account should be viewed under the cost method as contra to all of the stockholders' equity rather than any particular equity account. Its balance represents the owners' claims that have been satisfied by the distribution of corporate assets. The number of treasury shares should be disclosed in the description of the issue status of the shares, as shown in the following example: In this case, the balance of the Treasury Stock account is deducted from total equity, including Other Paid-In Capital and Retained Earnings. If both common and preferred treasury shares are held, they should be disclosed separately.Cost Method of Treasury Stock: Definition

Cost Method of Treasury Stock: Explanation

Examples

Cost Method of Treasury Stock FAQs

As explained above, when shares are acquired, the Treasury Stock account is debited and the cash account is credited. When the shares are reissued, cash is debited for the proceeds and Treasury Stock is credited for the amount paid out originally. In the event that cash received exceeds original cost, the additional paid-in capital account should be credited. If cash received is less than original cost, additional paid-in capital should be debited.

Treasury shares are the stock which is held by the issuer. They can be in the form of both common and preferred shares, depending on whether investors prefer risk or reward. These shares do not receive dividends and cannot effectively vote at meetings. These shares belong to the issuer even when they were initially issued at a discount rather than the market price.

Treasury shares are not considered as outstanding stock because they do not receive dividends and cannot effectively vote at meetings. They belong to the issuer even when they were initially issued at a discount rather than the market price. The outstanding stock is those which are held by investors.

Treasury shares are not considered as outstanding stock because they do not receive dividends and cannot effectively vote at meetings. They belong to the issuer even when they were initially issued at a discount rather than the market price. The outstanding stock is those which are held by investors.

Treasury shares are not considered as outstanding stock because they do not receive dividends and cannot effectively vote at meetings. They belong to the issuer even when they were initially issued at a discount rather than the market price. The outstanding stock is those which are held by investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.