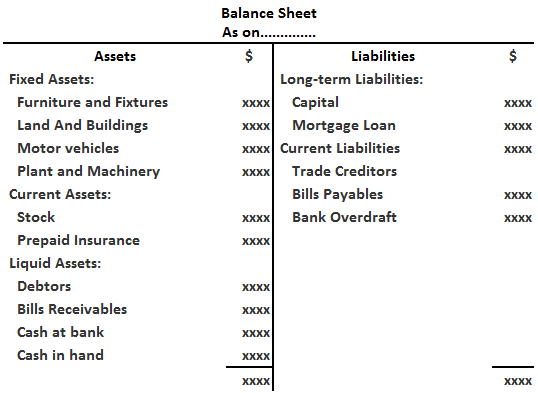

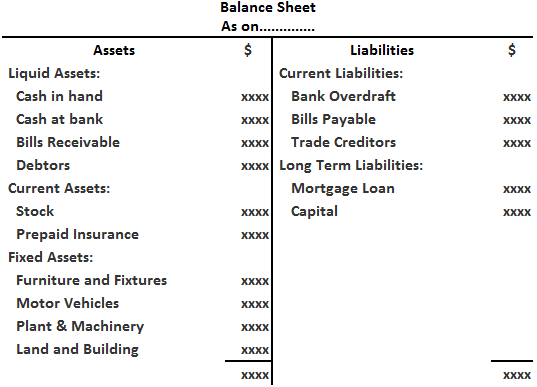

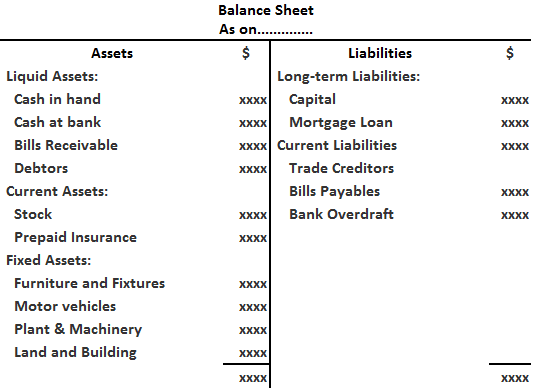

The arrangement of assets and liabilities on the balance sheet in a particular order is called marshalling. The main purpose of the balance sheet is to show the financial position of the business. Therefore, assets and liabilities on the balance sheet should be shown in the proper order that facilitates a good understanding of the firm's financial position. To serve this purpose, assets and liabilities are recorded on the balance sheet in a specific order. This order of assets and liabilities on the balance sheet is called marshalling. Under this method, assets are listed according to their permanency. Specifically, permanent assets are shown first and less permanent assets are shown afterward. Similarly, the fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. A specimen of the balance sheet marshalled using order of permanence is shown below. Under the order of liquidity method, an organization's current and fixed assets are entered in the balance sheet in the order of the degree of ease with which they can be converted into cash. Liabilities are presented based on the order of urgency of payment. This approach is generally used by sole traders and partnership firms. The following is the format of the balance sheet under the order of liquidity method. Under this order, assets are arranged according to the order of liquidity, whereas liabilities are arranged according to the order of permanency. The format of a balance sheet prepared using this method is shown below.Marshalling: Definition

Marshalling: Explanation

Methods of Marshalling

1. Order of Permanence

2. Order of Liquidity

3. Mixed Order

Marshalling of Balance Sheet FAQs

The ordering of the items in a balance sheet (assets and liabilities) is called marshalling.

Assets and liabilities can be arranged in the balance sheet according to two priorities: liquidity (1) and permanence (2).

Assets are prioritized by their liquidity, whereas liabilities are prioritized by their permanency.

“Marshalling” refers to a creditor’s right to realize his or her debt from assets acquired by another secured creditor. “Contribution” deals with the situation where two or more creditors have competing liens on one piece of property.

All balance sheets must follow the same format: assets are listed on the left, liabilities on the right, and net worth is listed beneath liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.