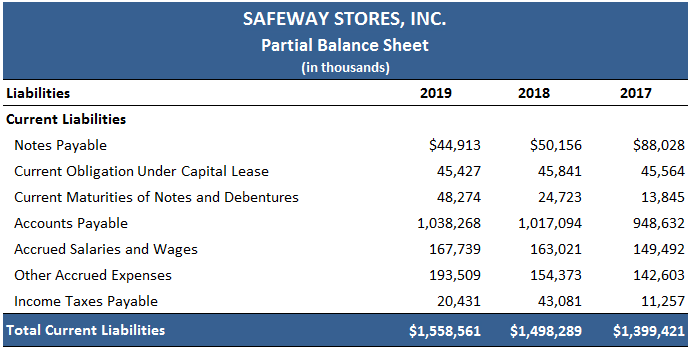

Current liabilities are those liabilities that will either be paid or will require the use of current assets within a year (or within the operating cycle, if longer), or that result in the creation of new current liabilities. When preparing a balance sheet, liabilities are classified as either current or long-term. Current liabilities require the use of existing resources that are classified as current assets or require the creation of new current liabilities. Current liabilities include accounts such as Accounts Payable, Short-term Notes Payable, Current Maturities of Long-term Debt (the principal portion of a long-term liability due within the next 12 months), Taxes Payable, and other Accrued Payables. Long-term liabilities are those liabilities that will not be satisfied within one year or the operating cycle, if longer than one year. Included in this category are Mortgages Payable, Bonds Payable, and Lease Obligations. As noted, however, the current portion, if any, of these long-term liabilities is classified as current liabilities. Like assets, liabilities are originally measured and recorded according to the cost principle. That is, when incurred, the liability is measured and recorded at the current market value of the asset or service received. Because current liabilities are payable in a relatively short period of time, they are recorded at their face value. This is the amount of cash needed to discharge the principal of the liability. No recognition is given to the fact that the present value of these future cash outlays is less. The present value is related to the idea of the time value of money. Essentially, the time value of money means that cash received or paid in the future is worth less than the same amount of cash received or paid today. This is because cash on hand today can be invested and thus can grow to a greater future amount. Therefore, the value of the liability at the time incurred is actually less than the cash required to be paid in the future. In connection with current liabilities, the difference between the value today and future cash outlay is not material due to the short time span between the time the liability is incurred and when it is paid. Current liabilities, therefore, are shown at the amount of the future principal payment. However, present value concepts are applied to long-term liabilities, liabilities with no stated interest, and liabilities with a stated interest rate that are materially different from the market rate for similar transactions. Liabilities are often divided into three categories: Definitely determinable current liabilities are those liabilities that are known and are definite in amount. Included in this category are accounts such as Accounts Payable, Trade Notes Payable, Current Maturities of Long-term Debt, Interest Payable, and Dividends Payable. The major accounting problems associated with these liabilities are determining their existence and ensuring that they are recorded in the proper accounting period. For example, if the cost of an item is included in the ending inventory but a corresponding payable and/or purchase is not recorded, both the cost of goods sold and total liabilities will be understated. Other definitely determinable liabilities include accrued liabilities such as interest, wages payable, and unearned revenues. Recognition of accrued liabilities requires periodic adjusting entries. Failure to recognize accrued liabilities overstates income and understates liabilities. A firm may receive cash in advance of performing some service or providing some goods. Since the firm is obligated to perform the service or provide the goods, this advance payment is a liability. These advance payments are called unearned revenues and include such items as subscriptions or dues received in advance, prepaid rent, and deposits. These liabilities are generally classified as current because the goods or services are usually delivered or performed within one year or the operating cycle (if longer than one year). If this is not the case, they should be classified as non-current liabilities. Firms are often required to make collections for third parties such as unions or governmental agencies. For example, as happens in many countries, taxes are levied on citizens and/or companies, and a firm may be required to collect tax on behalf of the taxing agency. Included in this category are sales and excise taxes, social security taxes, withholding taxes, and union dues. Other liabilities, such as federal and state corporate income taxes, are conditioned or based on the results of the enterprise's operations. The order in which current liabilities are presented on the balance sheet is a management decision. The current liability section of Safeway Stores Inc. shown below is typical of those found in the balance sheets of many US companies. That is to say, notes and loans are usually listed first, then accounts payable, and finally accrued liabilities and taxes.Current Liabilities Definition

Current vs Long-Term Liabilities

Measurement and Valuation of Current Liabilities

Types of Current Liabilities

Liabilities That Are Definitely Determinable

Liabilities That Represent Collections for Third Parties or Are Conditioned on Operations

Balance Sheet Presentation of Current Liabilities

Current Liabilities FAQs

A current liability is an amount owed by a company to its creditors that must be paid within one year or the normal operating cycle, whichever is longer.

Examples of current liabilities include accounts payable, short-term debt, accrued expenses, taxes payable, unearned revenue, and dividends payable.

A company can manage its current liabilities by ensuring it makes timely payments on all debts and obligations; monitoring cash flow to ensure ample liquidity; being aware of credit terms offered by suppliers; using cost-cutting measures and budgeting effectively; and negotiating payment terms with creditors.

Current liabilities are obligations that must be paid within one year or the normal operating cycle, whichever is longer, while non-current liabilities are those obligations due in more than one year.

High levels of current liabilities can negatively impact a company’s profitability due to high-interest payments on debts or other obligations. Companies should strive to keep their total amount of current liabilities as low as possible in order to remain profitable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.