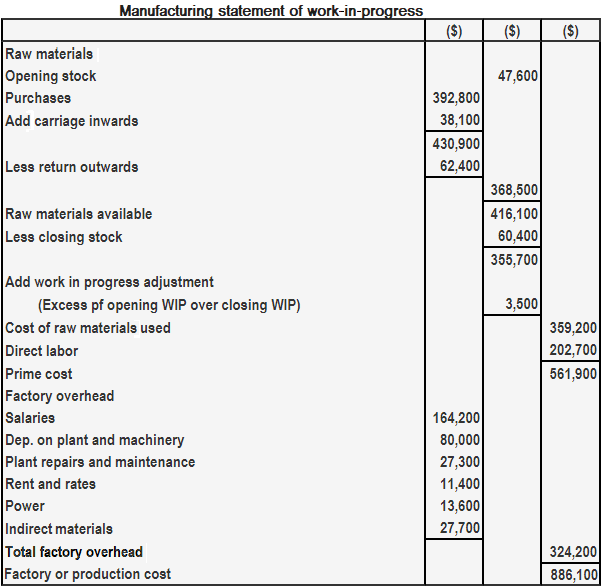

Any work-in-progress at the beginning of the financial year becomes part of the goods manufactured in that year, despite being fed into machines (in the form of raw materials and labor, etc.) in the previous year. The value of work-in-progress should, therefore, be excluded from the cost of goods manufactured in the year in which they were fed into the machines. Based on these points, it is reasonable to conclude that the value of the opening stock of work-in-progress should be added to the year's production cost. Also, the value of the closing stock of work-in-progress should be deducted from this to calculate the correct cost of goods manufactured for the year. Another way of arriving at the correct cost of goods manufactured is first to calculate the difference between the values of the opening and closing stocks of work-in-progress. Add the excess of opening stock over closing stock of work-in-progress to the production cost, or deduct the excess of closing stock over opening stock in progress to the production cost. The above entry is called a work-in-progress adjustment. It is entered into the production cost statement or manufacturing statement at a suitable stage, depending on the basis of the valuation of work-in-progress. Add the excess of opening stock over closing stock of work-in-progress to the cost of raw materials used. Alternatively, deduct the excess of closing stock over opening stock of work-in-progress to the cost of raw materials used before arriving at the final cost of raw materials used Add the excess of opening stock over closing stock of work-in-progress to prime cost. Alternatively, deduct the excess of closing stock over opening stock of work-in-progress to prime cost before arriving at the final prime cost. Add the excess of opening stock over closing stock of work-in-progress to production cost, or deduct the excess of closing stock over opening stock of work-in-progress to production cost before arriving at the final production cost. If an exam question doesn't clearly mention the basis for valuing work-in-progress, you should assume that it was made at production cost. Hence, the work-in-progress adjustment should be made at the end of the manufacturing cost statement, as shown above. Consider the following information about work-in-progress for a company: Required: Re-draw the company's manufacturing statement. Since the work-in-progress is valued at raw material content, the work-in-progress adjustment will be made at the time of arriving at the final cost of the raw materials used. The second point is that the opening stock of work in progress ($35,900) is greater than the closing stock ($32,400) by $3,500. Hence, the work-in-progress adjustment will be an addition to the cost of raw materials used by $3,500, as shown below.Accounting Treatment of Work-in-Progress

If Work-in-Progress is Valued at Raw Material Contents Only

If Work-in-Progress is Valued at Prime Cost

If Work-in-Progress is Valued at Production Cost

Example

Solution

Accounting Treatment of Work-in-Progress FAQs

Work-in-progress (WIP) is an accounting entry on a company’s balance sheet referring to the money spent on materials, processes, and labor to manufacture a product.

It is entered into the production cost statement or manufacturing statement at a suitable stage, depending on the basis of the valuation of work-in-progress.

Alternatively, deduct the excess of closing stock over opening stock of work-in-progress to the cost of raw materials used before arriving at the final cost of raw materials used.

Add the excess of opening stock over closing stock of work-in-progress to prime cost. Alternatively, deduct the excess of closing stock over opening stock of work-in-progress to prime cost before arriving at the final prime cost.

Add the excess of opening stock over closing stock of work-in-progress to production cost, or deduct the excess of closing stock over opening stock of work-in-progress to production cost before arriving at the final production cost.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.