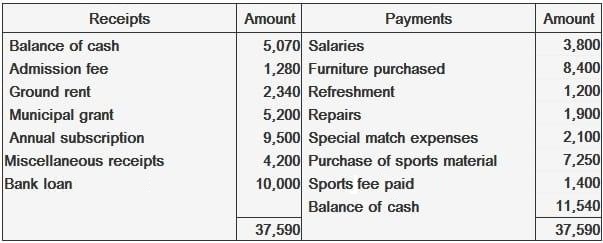

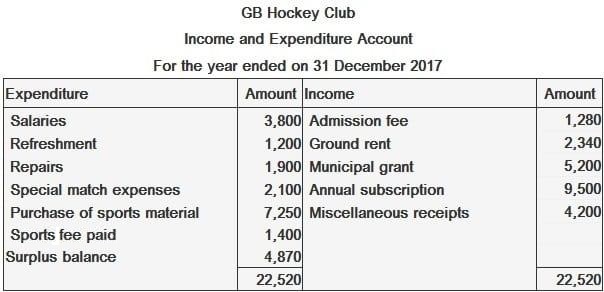

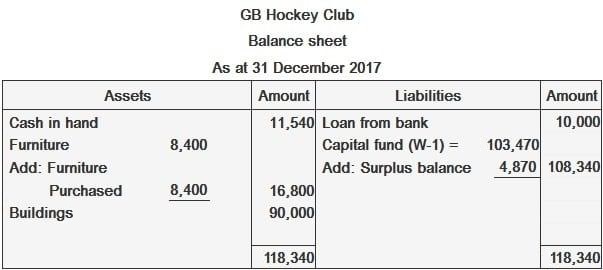

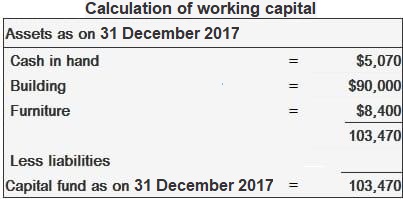

The balance sheet in a non-trading concern is prepared in a similar way to the approach followed in a trading concern. In both cases, the balance sheet can be prepared in account form or report form. If only the receipt and payment account is available, it is not possible to have a balance sheet. This is because complete information regarding the assets and liabilities will not be available from the books. A summary is given below of cash transactions for the GB Hockey Club for the year ended on 31 December 2017. In this example, the club owns buildings amounting to $90,000 and furniture of $8,400, as of 1 January 2017 Required: Prepare an income and expenditure account and balance sheet for the business as of 31 December 2017. W-1:Example

Solution

Balance Sheet of Non-Trading Concerns FAQs

An income statement shows money coming into your business and going out of it, while a balance sheet shows what you own and what you owe.

A balance sheet tells investors how much capital a business received from its owners, how the business is investing that capital, and what it has gained or lost.

It shows an organization's financial position at a specific point in time (there are many different types of balance sheets depending on which accounting method you use). It includes assets like cash, inventory, Accounts Receivable; liabilities like accounts payable, an owners investment; and owner's equity.

In the Accrual Basis of accounting, a business records revenue when it is earned and expenses when they are incurred, not when cash is exchanged. A balance sheet prepared on an Accrual Basis includes all assets and liabilities, including those that will be paid in the future.

If it's prepared on the cash basis of accounting, you only include the current assets and liabilities that are expected to require payment within one year or an operating cycle, whichever is longer. You would not include assets that are not expected to be liquidated, or liabilities that are due beyond the next 12 months.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.