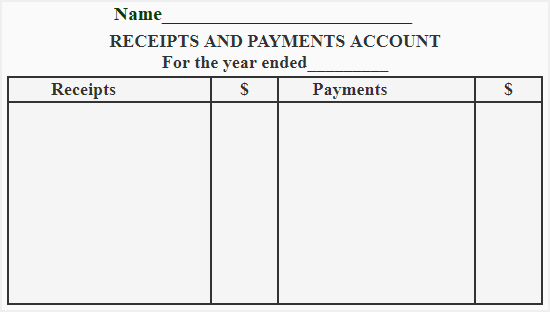

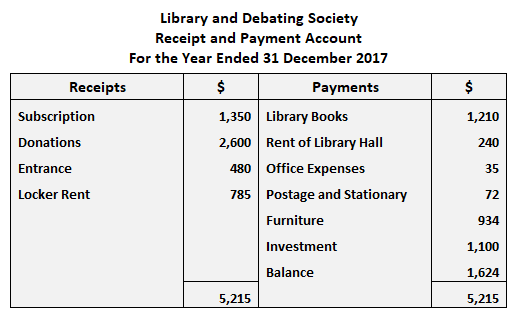

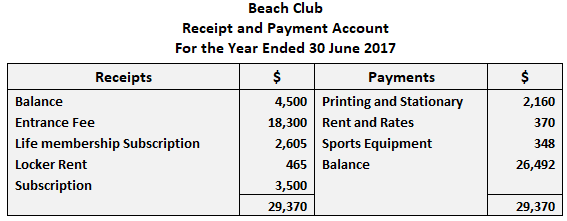

A receipts and payments account is a summary of actual cash receipts and payments extracted from the cash book over a certain period. All cash received and paid during the period, whether capital or revenue, is included in this account. Receipts are entered on the debit side of the receipts and payments account. This is the same as how receipts appear in the cash book. All receipts are grouped under headings such as entrance fees, annual subscriptions, lifetime subscriptions, donations, interest, and sundry receipts. All payments are entered on the credit side under headings such as salaries and wages, printing and stationery, office expenses, and rent, rates, and taxes. The receipts and payments account starts with the opening cash balance. It closes with the cash balance at the end of the period. Given that the receipts and payments account is simply a summary of cash transactions, it does not cover outstanding income or expenditure. It also naturally fails to show the actual income or expenditure of the period it covers. In a receipts and payments account, there is a receipts column on the debit side. This is used to record all receipts. There is also a payment column on the credit side, which is used to record all payments made by non-trading concerns or non-profit-making organizations during a specific accounting period (usually one year). The table below shows the format/specimen of a receipts and payments account. There are several important features associated with a receipts and payments account. First, a receipts and payments account is a summarized form of a cash book. It starts with an opening cash and bank balance (sometimes the two are merged) and ends with their closing balances. In a receipts and payments account, all receipts are recorded on the left-hand (debit) side and all payments are recorded on the right-hand (credit) side. The account contains a record of receipts and payments for both capital and revenue. It also includes all cash and bank receipts and payments for the current year, whether they are related to current, past, or future accounting periods. A receipts and payments account only contains records of transactions related to cash and bank. All non-cash items are excluded. Receipts and payments accounts are not part of the double entry system. These accounts show cash positions only, not surpluses or deficits for the period. They generally show debit balance, and in case of a bank overdraft, the bank balance will be credit. It is rare, but a receipts and payments account may also show nil balance. The last noteworthy feature of receipts and payments accounts is that they are always prepared at the end of an accounting period. The following are the advantages of a receipts and payments account: A receipts and payments account is prepared by extracting receipts and payments from the cash book for the entire year. In a cash book, each item is recorded separately in chronological order. However, the items in a receipts and payments account are recorded in classified form under different headings. To prepare a receipts and payments account, follow these steps: Step 1: Write the title of the account and use the format shown in the specimen. Step 2: Write the opening cash and bank balances at the top on the left-hand side. Step 3: Add up all the receipts with different dates under the same head. Step 4: Add up all the payments made on different dates under the same head. You can also use a separate sheet for this. Step 5: Write the sums of each head of receipts on the left-hand side and the total of each head of payments on the right-hand side. Step 6: Deduct all payments from all receipts and find the closing balance. A library and debating society was formed on 1st January 2017. The receipts and payments for the year ended 31 December 2017 are as follows: Receipts: Payments: Required: Show the receipts and payments account for the year ended 31 December 2017. Cash transactions for a beach club are shown below: Subscription: Printing and Stationery: Rent and Rates: Required: Prepare a receipts and payments account for the year ended 30 June 2017. Explanatory Note Adjustments regarding subscription, arrears for the last year, this year's advance, printing and stationery payable this year, payable last year, and rent and rates payable this year have not been recorded in the receipts and payments account. The reason for this is because these items do not affect the receipt or payment of cash.Definition

Explanation

Format/Specimen

Main Features

Advantages

Preparation of Accounts

Example 1

Solution

Example 2

Solution

Receipts and Payments Account FAQs

A receipts and payments account is a summary of actual cash receipts and payments extracted from the cash book over a certain period. All cash received and paid during the period, whether capital or revenue, is included in this account. Receipts are entered on the debit side of the receipts and payments account. This is the same as how receipts appear in the cash book.

First, a receipts and payments account shows total receipts and total payments under different headings. A receipts and payments account can be used to verify the cash book. The account provides classified records of different heads of receipts and payments. Lastly, it provides readily available data for preparing an income and expenditure account.

A receipts and payments account is prepared by extracting receipts and payments from the cash book for the entire year.

An income and expenditure account shows the net surplus or deficit for an accounting period, whereas a receipts and payments account only shows cash transactions. As such, the income and expenditure account is part of the double entry system, while the receipts and payments account is not.

A receipts and payments account can be used to verify the accuracy of the cash book by comparing the total of all receipts with the total of all payments. If these figures are different, it indicates that there is an error in the cash book.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.