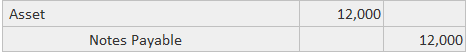

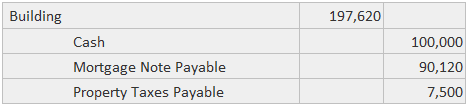

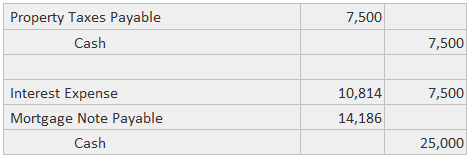

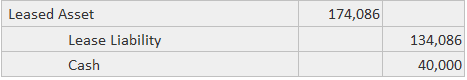

A firm can acquire operating assets by promising a seller to pay cash in the future and, in this way, creating a liability. The cost of an asset acquired in this way is equal to the present value of the future cash payments, as calculated using an interest rate that is realistic depending on the circumstances. For example, if a buyer gives a note with a realistic present value of $12,000, the following journal entry would be made: If a reliable fair value of the asset is known, that amount can be used for both the asset and the liability. The buyer may assume some of the seller's liabilities by agreeing to pay them when they are due. Typical assumed liabilities include those associated with mortgage notes payable and unpaid property taxes. Assumed liabilities are treated the same way as newly created liabilities if there is a material effect from discounting the future flows at a rate that is realistic for the circumstances existing at the date of the transaction. For example, suppose that a buyer acquires a building by paying $100,000 cash. The unpaid property tax liability is $7,500 and a mortgage note calls for five annual payments of $25,000 each. The nominal rate on the mortgage is 8%, such that its nominal present value at the purchase date is (PA 8% x $25,000), or $99,818. However, because the realistic rate at the purchase date is 12%, the realistic present value of the five payments is (PA 12% x $25,000), or $90,120. In this case, the following entry is appropriate: Subsequent entries to record the payment of taxes (if the effect of discounting is not material) and the first mortgage payment would be made as follows: The amount of interest expense is found by multiplying the realistic balance ($90,120) by the realistic interest rate (12%). A liability is also created when a firm enters a lease contract that is in substance a purchase. It is sufficient for the present discussion to observe that these leases are recorded by creating an asset and a liability account. The asset account is debited for the present value of all the cash payments, while the liability is credited for the difference between the asset amount and any payments made at the time of entering the lease. Suppose that a firm acquires exclusive use of an asset by agreeing to pay its owner six $40,000 annual payments. The first payment is due immediately (i.e., an annuity due situation), and the appropriate interest rate is 15%. The cost of the asset is (PAD 15% x $40,000), or $174,086. The entry to record this acquisition is:

Assumed Liabilities

Lease Liabilities

Example

Acquisition of Assets and Creation or Assumption of Liabilities FAQs

An example of an asset would be a piece of land or a building. Other examples include cash, investments, and inventory.

An example of a liability would be a loan that is owed to a bank. Other examples include accounts payable and wages payable.

Assets can be created or assumed in a number of ways, including through the purchase of property, the receipt of goods on consignment, or the assumption of debt.

When an asset is acquired, the corresponding liability is generally assumed by the acquirer. For example, if a company purchases a piece of land, it will also assume any outstanding mortgages or other debts associated with that property.

The impact on Financial Statements will depend on the particular transaction. In general, the acquisition of assets will increase the amount of assets reported on the balance sheet, while the assumption of liabilities will increase the amount of liabilities reported. The net effect will be to either increase or decrease the equity reported on the balance sheet.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.