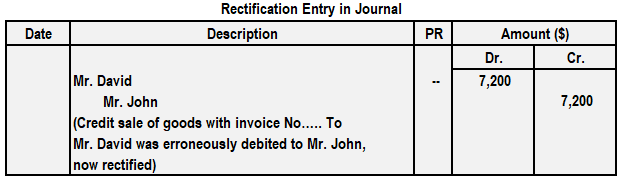

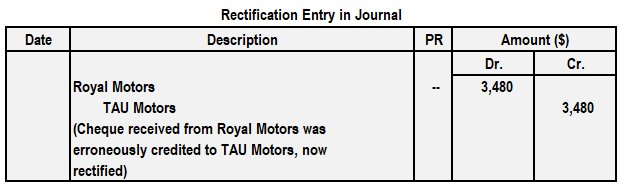

Errors of commission occur due to the negligence of the accountant or clerk. For this reason, they are often referred to as clerical errors or errors of inadvertence. Let's consider a few examples to show how errors of commission are caused: Other types of errors of commission may arise out of casting, posting, carryforward, and balancing. One of two effects is possible. Either the correct account will not be debited and an irrelevant account will be debited, or the correct account will not be credited and an irrelevant account will be credited. If an irrelevant account is debited instead of the correct account, follow these steps: If an irrelevant account is credited instead of the correct account, take these measures: A credit sale of goods for $7,200 to Mr. David was erroneously debited to Mr. John's account. A cheque for $3,480 was received from Royal Motors but was erroneously credited to TAU Motors' account.Errors of Commission: Definition

Effects on Accounts

Rectification of Entry

1. Debit the account that should have been debited

2. Credit the account that has been erroneously debited

1. Debit the account that has been erroneously credited

2. Credit the account that should have been credited

Example

Example

Errors of Commission FAQs

Errors of commission occur due to the negligence of the accountant or clerk. For this reason, they are often referred to as clerical errors or errors of inadvertence.

There are many types of errors of commission, but some of the most common include typing errors, medication errors, and equipment failures

The consequences of making an error of commission can vary depending on the severity and nature of the mistake. Generally, though, you can expect to face some sort of disciplinary action, such as a warning or even termination. You may also be liable for any damage or injuries that resulted from the mistake.

An error of commission is a mistake that is made while performing a task. An error of omission, on the other hand, is a mistake that is made by not doing something. For example, forgetting to file a report would be an error of omission.

Errors of commission are generally not covered by insurance policies. This is because they are considered to be preventable mistakes, and most insurers will not cover damages or injuries that result from them. However, you may be able to purchase additional coverage for this type of incident.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.