Retained earnings (RE) are created as stockholder claims against the corporation owing to the fact that it has achieved profits. Like all other equity claims, RE is not associated with any particular assets and certainly does not constitute a pool of cash or other assets. Four things can occur that change the amount of retained earnings, namely: The total earnings of a business are distributed to the following entities: The last two are related to management decisions, wherein it is decided how much to distribute in the form of a dividend and how much to retain. The higher the dividend rate, the lower the retained earnings. A company's management team always makes careful and judicious decisions when it comes to dividends and retained earnings. In layman's terms, retained earnings are a raincoat for the company, which it can make use of during difficult times. These can be used for expansion, modernization, and replacement of assets. Retained earnings are a good source of internal finance used by all organizations. The process of retaining earnings is also known as "plowing back profits." 1. Internal source: The main feature of retained earnings is that it is a good source of internal finance that does not create any long-term liability. 2. Uses of retained earnings: Retained earnings are a good source of funds to expand, modernize, and replace the firm's assets and aspects of its operations. 3. Flexibility: Retained earnings can be used freely. There is no fixed date of return and no cost to the company. 4. Capital addition: Retained earnings increase the base of the business, which helps the company in terms of future borrowing. 5. Indirect benefits to shareholders: Retained earnings offer tax benefits to shareholders. Companies do not need to pay interest as the cost of borrowed capital. 6. Enhancement of goodwill: Greater retained earnings is an index of business efficiency and profitability. Therefore, the top management can use it for expansion and modernization. The quantum of money that should be kept for future emergencies in the form of retained earnings (RE) depends upon the following points: 1. Nature of company: No set rule can be recommended for all companies regarding RE because it differs from organization to organization. Growing companies typically have high RE. 2. Amount of profit: A company's profitability will also decide the amount of RE, where the larger the profit, the larger the amount of RE. 3. Depreciation policy: Management should follow a depreciation policy that leads to a larger amount of depreciation in the initial years. 4. Class of shareholders: RE is influenced by the classification of shareholders. Low-income group shareholders always prefer more dividends rather than RE, whereas high-income group shareholders tend to favor wealth maximization. 5. Government tax policy: A company's earnings are affected by tax policies, and so higher taxation will reduce RE. 6. Degree of competition: A high level of competition in a company's industry will reduce the amount of RE. 7. Credit standing: Companies with better creditworthiness can secure loans at a cheaper rate and, as a result, their earnings will increase. 8. Age of company: Longstanding companies often have a high rate of profitability, meaning that RE will be high. Regarding the final point, it is notable that, in general, newly established companies have low profitability, while longstanding companies have greater chances of establishing a high rate of dividend as their retained earnings are higher. Retained earnings claims can be satisfied by distributing assets to stockholders through a dividend. The act of satisfaction involves three significant dates: 1. Date of declaration: The day on which the board of directors announces its intent to pay dividends and specifies the amount per share and other details. 2. Date of record: The day on which the recipients of the dividend are identified. Owners of stock at the close of business on the date of record will receive a payment. For traded securities, an ex-dividend date precedes the date of record by five days to permit the stockholder list to be updated and serves effectively as the date of record. 3. Date of payment: The day on which the assets are distributed to the stockholders of record. Distributions that actually satisfy owners' claims are cash, property, and liability dividends. For various reasons, some firms appropriate part of their retained earnings (RE). This action merely results in disclosing that a portion of the stockholders' claims will temporarily not be satisfied by a dividend. It should be understood that the claims remain part of RE. The appropriation may be established as part of a statutory requirement, primarily related to acquisitions of treasury stock. Although the laws of virtually all states in the United States limit dividends to an amount equal to the balance of retained earnings less the cost of treasury shares, few actually impose a requirement for formal appropriation. An appropriation may also be established in compliance with an agreement associated with major debt financing. While the intent of the appropriation requirement is to maintain the debtor's solvency, it does not work nearly as well as the more specific restrictions. Some firms disclose contingencies by appropriating RE. Prior to GAAP, this disclosure was often considered sufficient. As such, some firms debited contingency losses to the appropriation and did not report them on the income statement. GAAP specifically prohibits this practice and requires that any appropriations of RE appear as part of stockholders' equity. Any probable and estimable contingencies must appear as liabilities or asset impairments rather than an appropriation of RE. A fourth reason for appropriating RE arises when management wishes to disclose voluntary dividend restrictions that have been created to assist the accomplishment of specific organizational goals. For example, a firm may pass up a dividend in order to preserve its cash for the acquisition of a new factory. The following journal entry would be made if the amount is $1,000,000: The act of appropriation does not increase the cash available for the acquisition and is, therefore, unnecessary. It may be done, however, if management believes that it will help the stockholders accept the non-payment of dividends. The following journal entries would be prepared if the factory is acquired for $1,200,000: To naïve investors who think the appropriation established a fund of cash, this second entry will produce an apparent increase in RE and an apparent improved ability to pay a dividend. In reality, the purchase will have depleted the available cash in the company. As a result, the firm will be less able to pay a dividend than before the purchase was accomplished. Many firms restate (or adjust) the balance of the retained earnings (RE) account as they record the effects of events that have their origins in earlier reporting periods. GAAP greatly restricted this use of the prior period adjustment, but abuses have apparently continued because items affecting stockholders' equity are sometimes still not reported on the income statement. It generally limits the use of the prior period adjustment to the correction of errors that occurred in earlier years. When a prior period adjustment is used, it appears as a correction of the beginning balance of RE and is fully described. With the relative infrequency of material errors, the use of this type of adjustment has been virtually eliminated. A second situation in which an adjustment can be entered directly in the RE account and, in this way, bypass the income statement is in the context of quasi-reorganization. Retained earnings are reclassified as one or more types of paid-in capital under two general circumstances. The most common of these is the distribution of a stock dividend. The other is an action on the part of the board of directors to increase paid-in capital by reducing RE. One occasion for this decision is the desire to remove a voluntary appropriation without causing net inappropriate RE to increase. In the above portion, an attempt has been made to highlight the importance of retained earnings (RE). However, there are dangers associated with the use of RE, as shown below. A. Smaller dividends: When a policy of retaining profit is followed, shareholders will receive smaller dividends and the value of the company's shares will fall. B. Change in ownership: When the management decides to have a high rate of earnings for RE, many shareholders are likely to sell their shares. A. Overcapitalization: When a company has a sufficient amount in its RE account, the company will issue bonus shares, resulting in overcapitalization. B. Low-rate dividends: Excess RE reduces the future rate of dividends. C. Reduced loan facilities: High RE typically disturbs shareholders, potentially encouraging them to sell their shares. The goodwill of such companies suffers, which ultimately undermines their ability to secure loans.Retained Earnings: Definition

Retained Earnings: Explanation

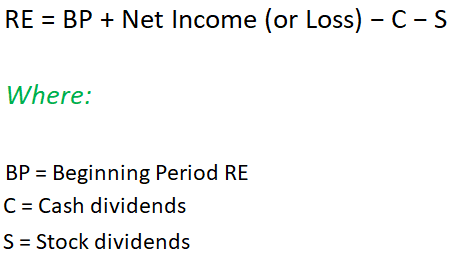

Formula For Retained Earnings

Characteristics/Features

Factors Affecting the Size of Retained Earnings

Satisfaction of Retained Earnings

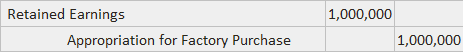

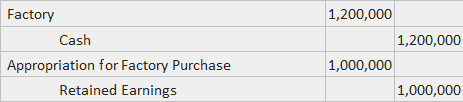

Appropriation of Retained Earnings (Journal Entries)

Restating Retained Earnings

Reclassification of Retained Earnings

Problems, Dangers, and Demerits of Excess Retained Earnings

1. Losses to Shareholders

2. Losses to the Company

Retained Earnings (RE) FAQs

Retained earnings refer to the portion of a company's profits that are reinvested back into the business, rather than being distributed to shareholders. This can be used to finance new projects or expand the business. Over time, retained earnings can have a significant impact on a company's growth and profitability.

Retained earnings are calculated by subtracting a company's total dividends paid to shareholders from its net income. This gives you the amount of profits that have been reinvested back into the business.

Retained earnings are important because they can be used to finance new projects or expand the business. reinvesting profits back into the company can help it grow and become more profitable over time.

Some benefits of reinvesting in retained earnings include increased growth potential and improved profitability. Reinvesting profits back into the business can help it expand and become more successful over time.

You can track your company's retained earnings by reviewing its financial statements. This information will be listed on the balance sheet under the heading "Retained Earnings."

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.