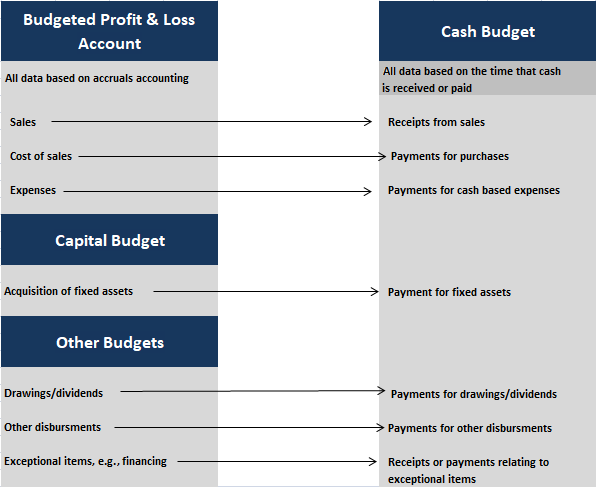

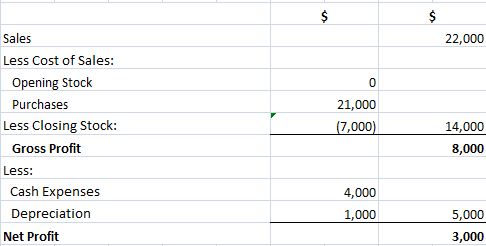

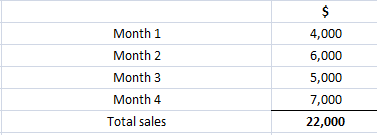

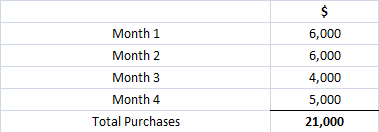

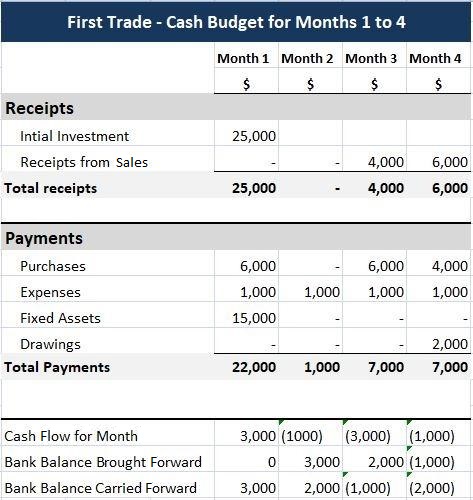

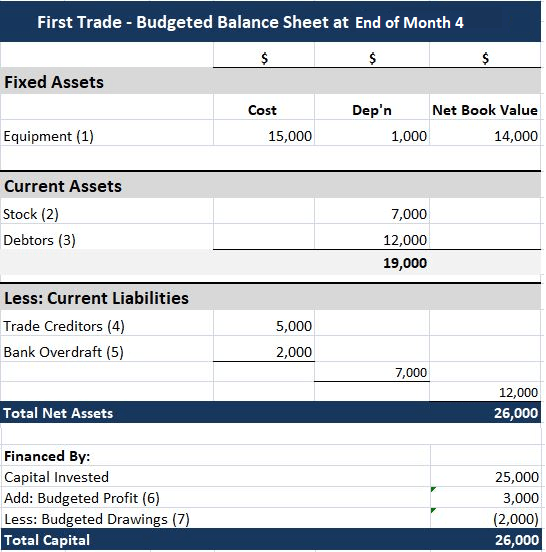

This article shows how to build up a cash budget using the receipts and payments account. We'll start by looking at the cash budget for a new trading organization, helping us to get a clear idea of the main principles. We'll also see how the cash budget fits in with the budgeted profit and loss account and balance sheet. Later on, we'll examine how to build on our technique to develop cash budgets for existing businesses by incorporating data from the opening balance sheet. The data used to create all budgets must be consistent. This ensures that all budgets are based on the same assumptions. We will find that much of the data needed for a cash budget can be found in a budgeted profit and loss account, if this has already been prepared. However, the key to accurate cash budgets is to remember that receipts and payments are based on when the receipts and payments occur, and therefore most of the figures in the budgeted profit and loss account will need analyzing or modifying. When we receive or pay cash at a different time to the recording of the sale, purchase, or expense, this is known as lagging. It is these lagged figures—based on the time of the receipt or payment—that we will use in our cash budget. For example, if credit sales of $10,000 were made in January on two months' credit, then the money will be received in March. Although the sale would be recorded in the profit and loss account in January, it must appear in the March column in the cash budget. A cash budget will not show any non-cash items that appear in the budgeted profit and loss account; the most common example of this is depreciation. There are also items that will appear in the cash budget, but are not shown in the budgeted profit and loss account. These are capital items (purchase or disposal of fixed assets), disbursements like drawings and tax, and exceptional items like financing (funds from equity or loans). The diagram below shows how the data in a simple cash budget links with the data used in other budgets. In the case study below, we'll consider how a simple cash budget can be generated for a new business. To do so, we'll use the sources of data shown in the diagram above. Jim First is planning to start a trading business, First Trade Ltd. He has prepared the following budgeted profit and loss account for the initial four months of trading. Jim First: Budgeted Profit & Loss Account Jim has also provided the following information about his plans: Required: Prepare a cash budget in the receipts and payments format for the first four months trading of First Trade. The cash budget is prepared in the following way: Cash flow for month + Bank balance brought forward = Bank balance carried forward The closing bank balance (bank balance carried forward) for one month is then entered as the opening bank balance for the following month (bank balance brought forward). The cash budget shows that if everything goes according to plan, Jim's business bank balance will be $3,000 in credit at the end of month 1, but will fall to an overdrawn balance of $2,000 by the end of month 4. Therefore, Jim should make suitable financial arrangements if he wishes to follow this budget. He should also consider the impact of unforeseen events (e.g., sales may be lower than forecasted and expenses may be higher). This type of "what-if?" planning process is referred to as sensitivity analysis. A full set of budgets for an organization includes a budgeted balance sheet at the end of the budget period, as well as a budgeted profit and loss account and cash budget. The budgeted balance sheet is based on the same format as the historical balance sheet produced for financial accounting purposes; however, is based in the future. It is a statement of the expected assets, liabilities and capital at the end of the budgeting period. Because this document will tie in with the other two main budgets, it incorporates the profit generated in the budgeted profit and loss account, along with the final cash or bank balance as predicted in the cash budget. The budgeted profit and loss account and the budgeted balance sheet are together known as the master budget. Several subsidiary budgets often have to be created in more complex businesses in order to build up sufficient information to create the master budget and the budgeted cash flow statement. Examples of subsidiary budgets include the sales budget, production budget, and materials usage budget. To understand how cash budgets work, we need to be able to create a budgeted balance sheet either in full or in extract form. By creating a full-budgeted balance sheet, we can also check that our budgets link together properly and that the final result balances. Of special importance are the following links between the cash budget and the budgeted balance sheet at the end of the budget period: Regarding the final link mentioned above, in a similar way to sales, these are typically the purchases or expenses for the final period(s) that do not appear in the cash budget. At this point, let's return to the case study of First Trade Ltd. to see how the budgeted balance sheet can be developed in practice. As described in the first case study, Jim First is planning to start a trading business. Jim has prepared a budgeted profit and loss account for the initial four months trading, showing a budgeted profit of $3,000. Required: Prepare a budgeted balance sheet for the end of month 4. The budgeted balance sheet is shown below. Notes are also given to show how each figure was calculated. Notes: (1) The fixed assets were bought in month 1. They are valued at cost, less the depreciation shown in the budgeted profit and loss account (i.e., since this is also the cumulative depreciation). (2) The stock figure is the closing stock used in the budgeted profit and loss account. (3) The debtors figure is made up of the sales for months 3 and 4 ($5,000 + $7,000). The proceeds of these sales will not have been received within the budget period since the sales are made on 2 months' credit. (4) The trade creditors figure is the month 4 purchases that are not due to be paid until month 5. (5) The bank overdraft is the final closing balance on the cash budget. (6) The budgeted profit is as recorded on the budgeted profit and loss account. (7) The budgeted drawings are as recorded in the cash budget. It is worthwhile to examine the above figures and notes, ensuring that you understand how the figures were arrived at. Note that the budgeted balance sheet should balance when the data are used consistently.Basic Process of Preparing a Cash Budget

Linking With Other Budgets

Case Study

First Trade Ltd. Simple Cash Budget

Solution

Note that the sales made in months 3 and 4 do not appear on this cash budget as the money will not be received until months 5 and 6.

Remember that the first month's purchases are paid for in month 1 and subsequent purchases are given one month's credit.

Linking Cash Budget With the Budgeted Balance Sheet

Cash Budget and Master Budget

Subsidiary Budgets

Cash Budget and Budgeted Balance Sheet

These are typically the sales for the final period(s) where receipts do not appear in the cash budget.

If this is a negative figure, it will be recorded as an overdraft under current liabilities.

Case Study

First Trade Ltd. Preparing a Budgeted Balance Sheet

A cash budget has also been prepared that shows an overdrawn bank balance of $2,000 at the end of month 4.Solution

How to Prepare a Cash Budget for a New Business FAQs

A cash budget should be prepared if the company expects to have a negative cash flow for the budget period. This means that the company will need to borrow money, or raise capital from other sources, in order to finance its operations.

When projecting your sales, you should consider the following factors:- the current market conditions- your company’s competitive environment- the expected demand for your products or services

You should project your expenses by considering the following factors:- the current market conditions- your company’s competitive environment- the expected demand for your products or services- the likely changes in your costs of goods sold or operating expenses.

If you don’t have enough information to project your sales and expenses, you should estimate them. If this is the case, you should include an explanation on your cash budget to indicate why they are estimates.

A company that monitors its cash position regularly will already have much of the information required for preparing a cash budget on hand. This information can be used to prepare a cash budget. For those that don’t monitor their cash position regularly, you should start by determining whether your business will have a negative or positive cash flow for the budget period.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.