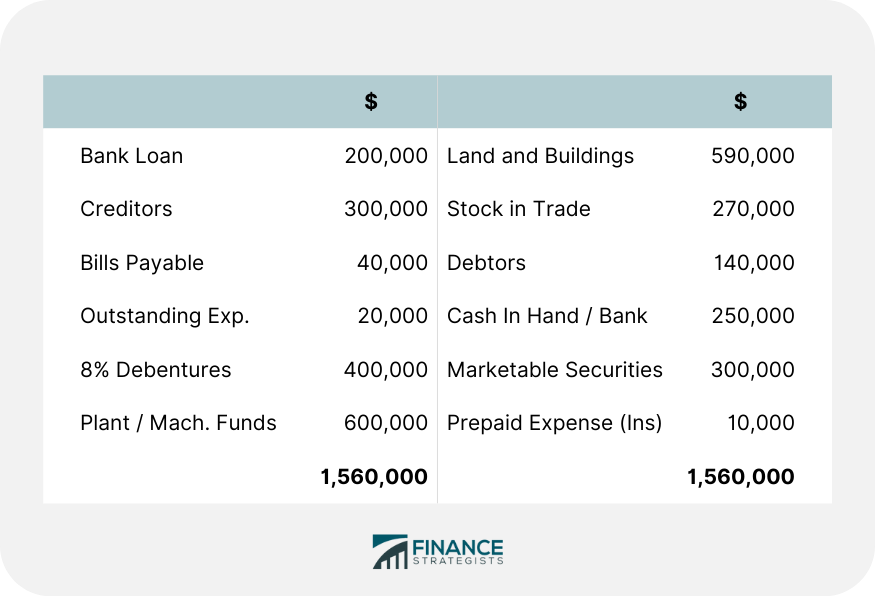

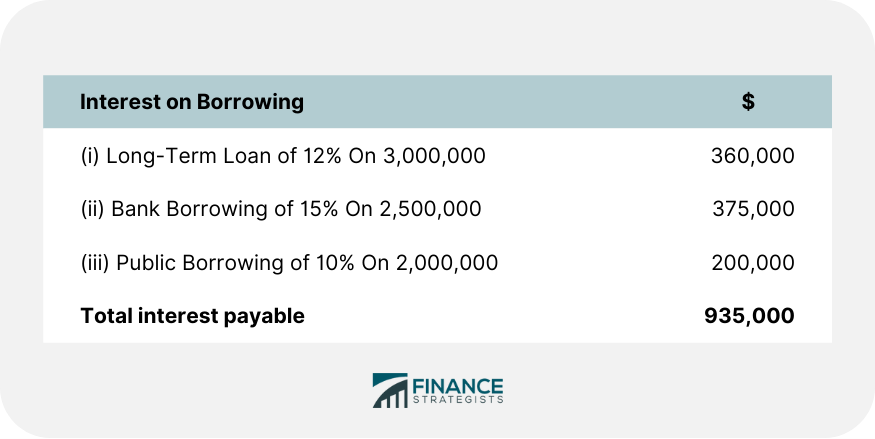

To answer the question in the title, this article defines, explains, and provides examples of all the importance balance sheet ratios. The current ratio can be calculated as follows: Current ratio = Current assets / Current liabilities In this formula: The term liquidity refers to the ability of a company to pay its short-term liabilities as and when they are due for payment. Out of current assets, inventories and prepaid expenses are not included because these cannot be converted into cash easily. Therefore, to calculate the quick ratio, you can use the following formula: Quick ratio = (Current assets - Stocks prepaid) / Current liabilities Calculate the quick ratio from the balance sheet shown below. Quick assets = $140,000 + 250,000 + 300,000 = $690,000 Current liabilities = $300,000 + 40,000 + 20,000 = $360,000 Quick ratio = 690,000 / 360,000 = 1.916 times Hint: A bank loan is a long-term liability, while a bank overdraft is considered a current liability. Quick Assets: Don't include stock and prepaid expenses. Calculate current assets and current liabilities when the current ratio is 2.5 and working capital is $180,000. Working capital = Current assets - Current liabilities Current Ratio = CA : CL = 2.5:1 Therefore: 180,000 / 1.5 = 120,000 CA = $120,000 x 2.5 = $30,000 CL = $120,000 x 1 = $120,000 Calculate current assets, liquid assets, and inventory from the following data: To calculate current assets: Current ratio = Current assets / Current liabilities 2.5 = Current assets / 50,000 Current assets = 2.5 x 50,000 Current assets = $125,000 To calculate liquid assets: Acid test ratio = Liquid assets / Current liabilities 1.5 = Liquid assets / 50,000 Liquid assets = 1.5 x 50,000 = $75,000 To calculate inventory: Inventory = Current assets - Liquid assets = $125,000 - 75,000 = $50,000 This ratio is a claim of creditors to the assets of the organization. It is calculated by dividing total assets (i.e., current assets and long-term assets) by tangible network. When the debt-to-equity ratio is high, it means that creditors have invested more in a business than the owners, and the creditors will suffer more in adverse times than the owners. Therefore, creditors prefer low debt-to-equity ratios. To calculate the debt-to-equity ratio, use the following formula: Debt-to-equity ratio = Outsiders' funds / Shareholders' funds An alternative version of this formula is: Debt-to-equity ratio = External equities / Internal equities This ratio establishes the relationship between shareholders' funds and total assets of the firm. It is useful for evaluating the long-term solvency of a company. Shareholders' funds include equity, preference share capital, profits or losses, reserves, and surplus. The equity ratio is calculated as follows: Equity ratio = Shareholders' funds / Total assets Shareholders' funds amounts to $400,000 and total assets are $600,000. Using this information, the equity ratio is calculated as follows: Equity ratio = 400,000 / 600,000 = 2:3 Comment: A high equity ratio is an indicator of the long-term solvency position of a company. The solvency ratio is calculated using the following formula: Solvency ratio = Total liabilities to outsiders / Total assets Suppose that total liabilities are $400,000 and total assets are $800,000. Therefore, to calculate the solvency ratio, we perform the following: Solvency ratio = 400,000 / 800,000 = 1:2 Comment: The lower the ratio of total liabilities to total assets, the better the company's position. This ratio is useful in establishing a relationship between fixed assets and shareholders' funds (i.e., share capital reserves and retained earnings). It is calculated as follows: Fixed assets to net worth ratio = (Fixed assets - Depreciation) / Shareholders' funds Suppose that the depreciated book value of fixed assets is $800,000 and shareholders' funds amount to $400,000. In this case, the fixed assets to net worth ratio is calculated in the following way: = 800,000 / 400,000 = 2:1 Comment: When this ratio indicates how the funds are used, the best criteria is that fixed assets should be greater than shareholders' funds. This ratio is calculated by dividing the total of current assets by the shareholder's fund. In other words: Ratio of current assets to proprietor's fund = Current assets / Shareholder's funds Suppose that current assets are $400,000 and shareholders' funds amount to $800,000. The ratio would be calculated as follows: = 400,000 / 800,000 = 1:2 Comment: This ratio reflects the extent to which proprietor's funds are invested in current assets. This ratio focuses on the debt-serving capacity of a firm. It is popularly known as the interest coverage ratio or fixed charges cover. The ratio is calculated by dividing Earnings Before Interest and Taxes (EBIT) by fixed interest charges, namely: Interest coverage ratio = EBIT / Fixed interest charges The net profit (after tax) of a corporation is $150,000 and its fixed interest on long-term borrowing is $20,000. The rate of income tax is 60%. The interest coverage ratio is calculated as follows: Interest coverage ratio = EBIT / Fixed interest charges = (150,000 + Tax 90,000 + Interest 20,000) / 20,000 = $260,000 / 20,000 = 13 times A company's EBIT is $1,500,000. The details of the company's borrowings are: The company's sales are increasing and, consequently, it needs to borrow a further $2,000,000 from the bank. In this case, EBIT will increase by 25%. Required: Calculate the change in the interest coverage ratio after the additional borrowing. = 1,500,000 / 935,000 = 1.60 times When additional borrowing of $20,00,000 is taken: (2,000,000 x 15) / 100 = 300,000 (interest) Thus, interest liability will be 9,35,000 + 300,000 = 1,235,000 Tax will increase by 25% Thus, (1,500,000 x 20) / 100 = $300,000 = 1,500,000 + 300,000 = $1,800,000 New change rates = 1,800,000 / 1,235,000 = 1.45 timesCurrent Ratio

Quick Ratio (or Acid Test Ratio or Liquid Ratio)

Example 1

Quick ratio = Quick assets / Current liabilitiesExample 2

Solution

Example 3

Solution

Debt-To-Equity Ratio

Proprietary Ratio (or Equity Ratio)

Example

Solvency Ratio (or Ratio of Total Liabilities to Total Assets)

Example

Fixed Assets to Net Worth Ratio (or Fixed Assets to Proprietors Fund)

Example

Ratio of Current Assets to Proprietor’s Fund

Example

Debt-Service Coverage Ratio (or Interest Coverage Ratio)

Example 1

Example 2

Solution

Interest coverage ratio = EBIT / Total interest liability

Balance Sheet Ratios Explanation With Examples FAQs

Balance sheet ratios are calculations that use elements of a company's balance sheet to measure its financial performance and health.

We can use balance sheet ratios to help us understand how well a company is performing financially, how much debt it has, and how easily it could pay its debts if they came due.

Some common balance sheet ratios include the debt-to-equity ratio, the current ratio, the acid-test ratio, and the inventory turnover ratio.

A company's debt-to-equity ratio should ideally be as low as possible. This means that the company has more equity than debt.

To calculate a company's current ratio, divide its total current liabilities by its total current assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.