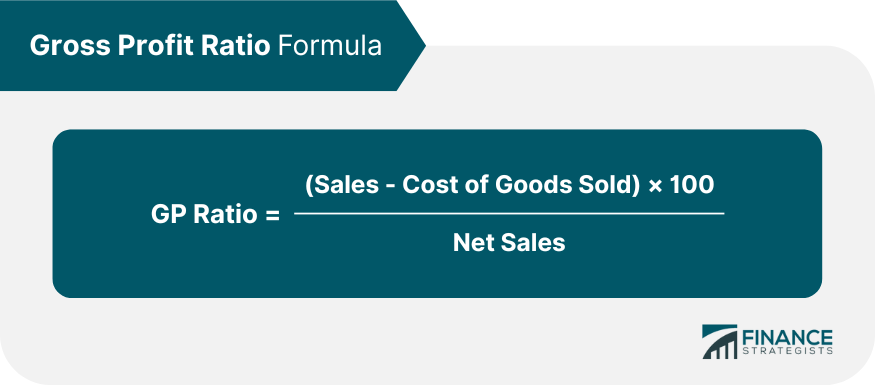

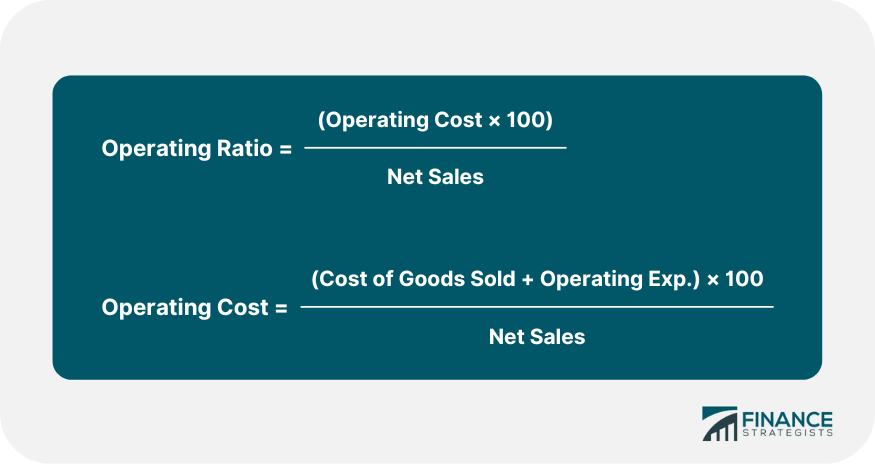

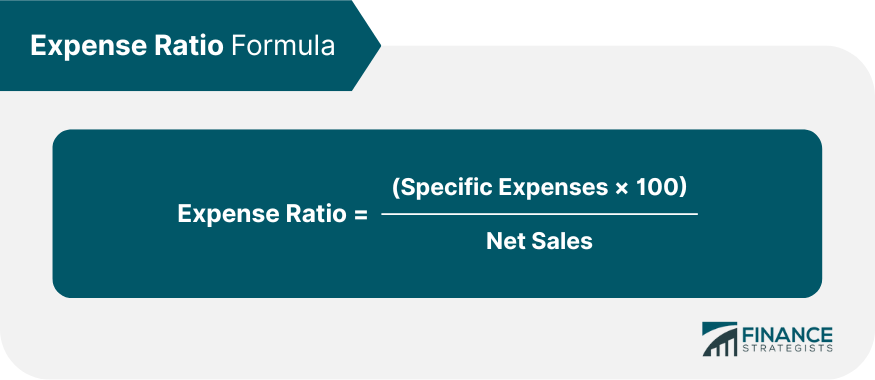

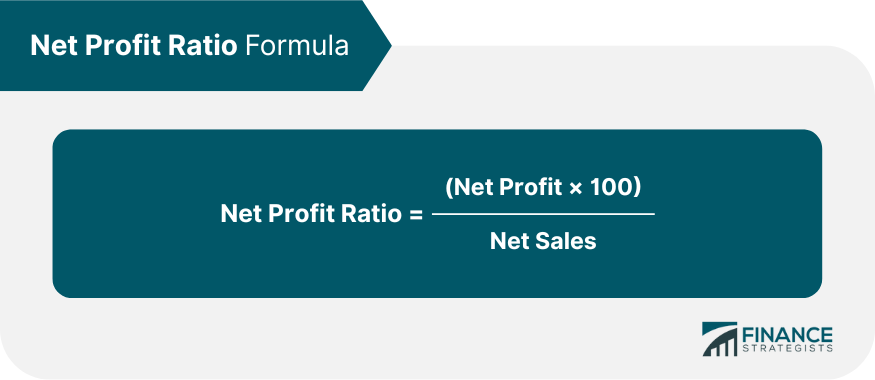

The main aim of all business enterprises is to earn profit. Moreover, earning profit is considered essential for business prosperity. Profit is like the engine that drives the business forward. It is also the key to examining the efficiency of the company. Profits are always measured in terms of sales or investment. These ratios are expressed in terms of percentage and always on sales. The following important formulae should be understood: This ratio measures the relationship of gross profit to net sales. In general, this percentage is calculated on sales. The formula for the gross profit ratio is as follows: Consider the following information and calculate the gross profit ratio: At the outset, we need to calculate net sales. This is calculated as follows: Net sales = $320,000 - 20,000 = $300,000 To calculate the gross profit ratio, the following working is used: GP = Net sales - Cost of goods sold = 300,000 - 200,000 = $100,000 GP ratio = (GP x 100) / Net sales = (100,000 x 100) / 300,000 GP ratio = 33.33% The operating ratio is useful to identify the relationship between the cost of goods sold and other operating expenses, on the one hand, and sales on the other hand. Here, operating cost is divided by net sales. In other words: Consider the following: Solution Operating ratio = (Operating cost x 100) / Net sales $300,000 + 40,000 + 60,000 = 400,000 = 400,000 x 100 / 600,000 = 66.66% Comment: Two-third of the sales are consumed by operating costs. The balance is to cover up the interest charges, income tax, dividends, and retention of profits. This ratio reflects how much of sales is consumed by operating costs. A higher operating ratio is always harmful because a small margin is left for interest, income tax, dividends, and reserves. It is a test of a company's operating efficiency. The operating profit ratio is calculated as follows: Operating profit = Net sales - Operating cost or Net sales - Cost of goods sold + Operating cost Therefore: Net operating profit = Net profit + Non-operating exp. - Net operating income - Operating profit ratio = 100 - Operating ratio From the following information, calculate the operating profit ratio: Operating profit ratio = (Operating profit x 100) / Net sales = 600,000 - (400,000 + 30,000 + 50,000) = $120,000 Operating profit ratio = 120,000 x 100 / 600,000 = 20% Various expenses are related to total net sales. The lower the expense ratio, the greater the profitability, whereas the higher the ratio, the lower the profitability. The expense ratio is calculated as follows: The net profit ratio is calculated as follows: While calculating net profit, there are two schools of thought. This ratio is very useful from the perspective of shareholders. This ratio is popularly known as return on investment (ROI). It indicates the relationship between net profit after interest and tax and the proprietor's funds. To calculate ROI, use the following formula: ROI = Net profit (after tax and interest) x 100 / shareholders' funds Here, net profit is defined as follows: Net profit = Out of Profit - Interest and income Also, to calculate shareholders' funds, use the following formula: Shareholders' funds = Equity + Preference share capital, share premium, Retained earnings + surpluses, general reserves Example Consider the following information: Shareholder's investment Share capital $200,000 + 200,000 + 100,000 = $500,000 Return on shareholders' investment = Net profit after tax x 100 / Shareholders' investment = 80,000 x 100 / 5,00,000 = 16% Comment: ROI is useful when measuring a company's profitability, and so shareholders and management are interested in it. The greater the ratio, the higher the level of efficiency that the company has used shareholders' funds.Profitability Ratios

Gross Profit Ratio

Example

Solution

Operating Ratio

Example

Operating Profit Ratio

Example

Solution

Expense Ratio

Net Profit Ratio

Return on Shareholders' Investment or Net Worth

Reserved and Surplus

Revenue reserves

40,000

Capital reserves

30,000

Reserves for emergencies

30,000

100,000

Net profit before tax and interest

200,000

Interest charges

40,000

Tax rate

50%

Required: Calculate the return on shareholders' investment.Solution

Net profit before interest and tax

200,000

Less: Interest

40,000

160,000

Less: 50% tax

80,000

80,000

Explain Profitability Ratio With Examples FAQs

Return on assets (ROA) reflects how efficient a company is in using its assets to generate profits. It helps an investor understand the profitability of the enterprise with reference to its total assets. Higher ROA usually indicates greater efficiency.

Operating profit ratio, also known as operating margin ratio, refers to the amount of money earned by a company through its operations expressed in percentage terms. It shows how much it costs for a company to make one dollar of revenue. This metric is especially useful when comparing profitability among different companies or industries with varying cost structures.

Revenue ratio, also known as sales to total assets ratio, refers to the amount of money earned by a company through its operations expressed in percentage terms. This metric is especially useful when comparing profitability among different companies or industries with varying cost structures. The higher the ratio, the better for the business.

Return on sales (ROS) is a profitability ratio which reflects how efficient an organization is in utilizing its total assets to generate revenues. Since ROS also takes into account the total assets, it provides a more complete picture of the company's overall efficiency.

Return on equity ratio is a profitability ratio which reflects how profitable companies are in relation to their shareholders' investment. It shows how much money returns to the owners for each dollar invested by them, which enables investors to determine whether it would be worthwhile investing more funding into the company.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.