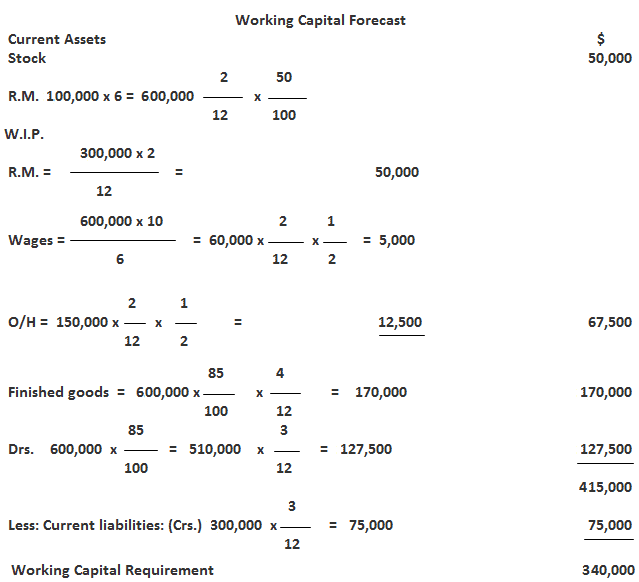

X Ltd Co. wants to estimate its working capital using the operating cycle method when: Customers are given 60 days of credit and 50 of days credit from suppliers. The 40-day supply of raw materials and a 15-day supply of finished goods are kept in store. The production cycle lasts 20 days. All materials are issued at the start of each production cycle. One-third of the average working capital is kept as a cash balance for contingencies. (c) No. of operating cycles in the year = 365 / 85 = 4.3 (d) Working capital = 87,500 / 4.3 = $20,349 Add: Reserve for contingencies 1 / 3 = 6,789 / $27,132 Contingencies allowances = 15% Required: Calculate the amount of working capital. Account Receivables (Drs) Local sales = (1,56,000 x 2) / 52 = $6,000 Outside sales = (6 x 6,24,000) / 52 = $72,000 Less: Current Liabilities Accounts Payables (Crs.) = (1,92,000 x 4) / 52 = $14,770 O/S Wages = (5,20,000 x 2) / 52 = $20,000 Add: 15% for contingencies = 10,385 Total working capital required = $79,615 John Trading Co. has asked you to prepare a working capital forecast using the following information: Raw materials remain in stores for 2 months, finished goods remain in stores for 4 months, the credit allowed by crs. is 3 months from the date of delivery of goods (Rm), and the credit given to Drs. is 3 months from the date of dispatch. The production cycle is 2 months. Additionally, the sale price per unit is $6, and production and sales are uniform throughout the year. Libro Ltd. has $350,000 share capital, $70,000 G.R., $300,000 fixed assets, $30,000 stock, $97,500 Drs., and $15,000 Crs. The company proposes increasing the business stock level by 50% at the end of the year. Credits are doubled and it is proposed that machinery worth $15,000 should be purchased. Estimated profit during the year is $52,500 after changing $30,000 depreciation and 50% of profit for taxation. Advance income tax is estimated at $45,000. Credits are likely to be doubled, 5% dividends will be paid, and 10% dividends are to be proposed for the next year. Drs. are estimated to be outstanding for 3 months. The sales budget shows $750,000 as sales for the year to make a working capital forecast by the projected balance sheet method.1. Estimating Working Capital Requirement Using Operating Cycle Method

Problem

Solution

Total Op. Exp. For the Year

$

R.M. 20,000 x 250

50,000

Labor 20,000 x 1

20,000

Overheads

17,500

87,500

Period of Production cycle

Days

Material storage days (pds.)

40

Finished goods storage (pds.)

15

Production cycle storage (pds.)

20

Av. collection (pds.)

60

135

Less: average payment (crs.)

50

85

2. Using Working Capital Method

Problem

$

Raw materials (needed)

10,000

Store value

16,000

Average credit givers:

Local sales 2 weeks credit

1,56,000

Outside sales 6 weeks credit

6,24,000

Time lag payment:

For purchase (4 weeks)

1,92,000

For wages (2 weeks)

5,20,000

Solution

Inventories: R.M.

$10,000

Stock of Store

$16,000

$26,000

3. Using Cash Forecasting Method

Problem

Solution

4. Using Projected Balance Sheet Method

Problem

Solution

(i) Sh. cap.

Fixed assets

300,000

Cap. (Given)

350,000

350,000

M. proposed purchase

15,000

Res. and surplus

70,000

Less dep.

315,000

17,500

30,000

Less dividend 10%

52,500

285,000

52,500

C.A.

+ Profit after tax

105,000

70,000

Stock 30,000 + 50% add. drs. 15,000

45,000

Less proposed div. 10%

35,000

Adv. tax 45,000

187,500

Current liabilities

277,500

Crs. 15,000

+ (k) 15,000

30,000

Tax provision

52,000

Proposed div.

35,000

O/D (balance figure)

25,000

170,500

562,500

562,000

Estimating Working Capital Requirements FAQs

Working Capital is the difference between current assets and current liabilities. It represents the amount of money which a company has in hand to run day to day business.

To solve Working Capital requirement problems, you must first understand what they are asking for. Then determine how much of each current asset and current liability the company needs to have on hand so it can meet its short term obligations. Once you have determined these amounts add them all up to get the total Working Capital.

Working Capital = current assets – current liabilities. The number will always be a positive amount because it represents how much money the company has in hand to meet its short term financial obligations. If current assets are greater than current liabilities, you have a positive Working Capital position or what is called a funding surplus. If current liabilities are greater than current assets you have a negative Working Capital position or what is called a shortfall.

No, it is not. Working Capital represents the difference between current assets and current liabilities at a given point in time whereas net worth represents all of the assets and liabilities of a company at a given point in time. Net worth is equal to total assets less total liabilities and shareholders' equity which includes the capital stock, Retained Earnings and other forms of equity.

Net worth = total assets – total liabilities. The number will always be a positive or negative amount. If total assets are greater than total liabilities, you have a positive net worth position and if liabilities are greater than assets you have a negative net worth position.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.