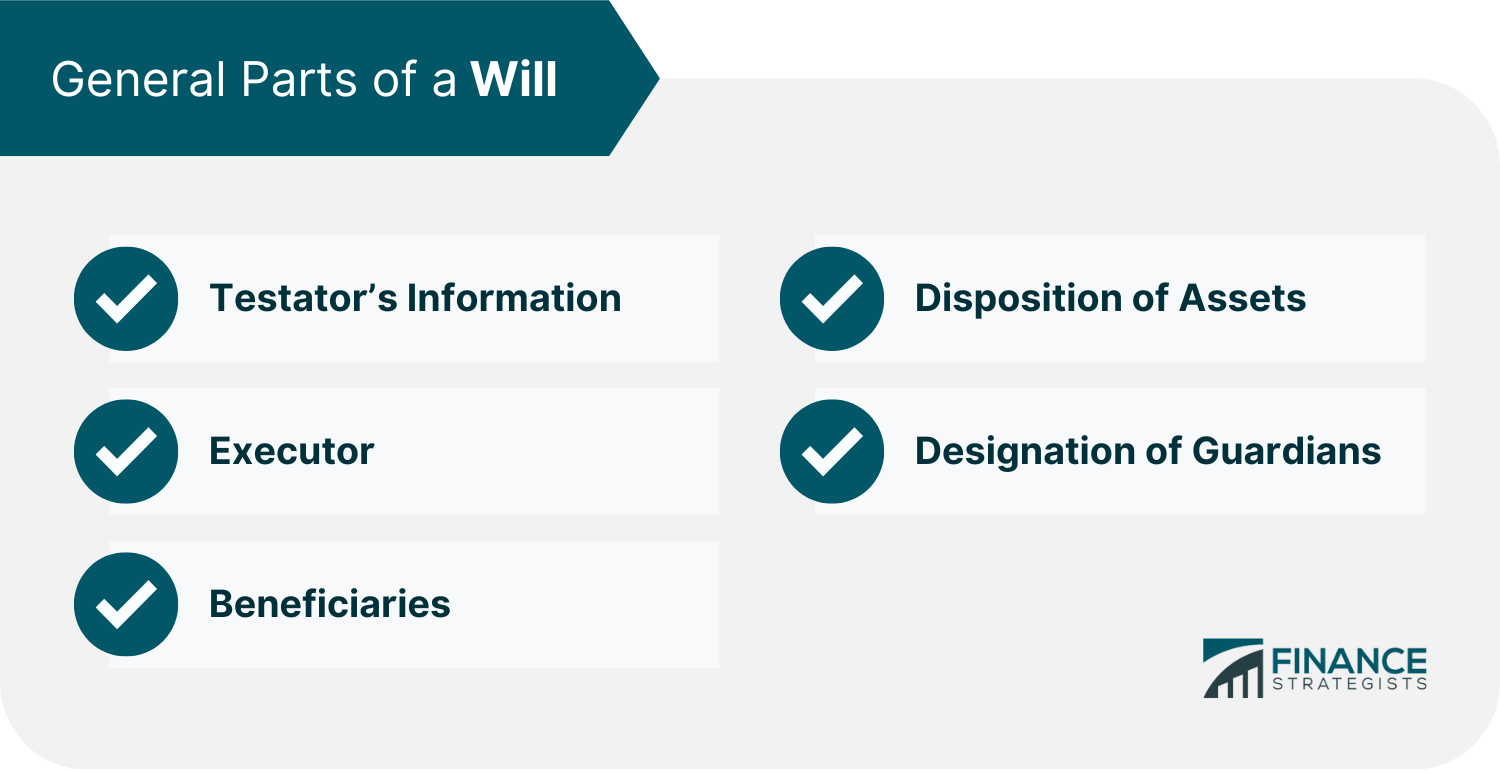

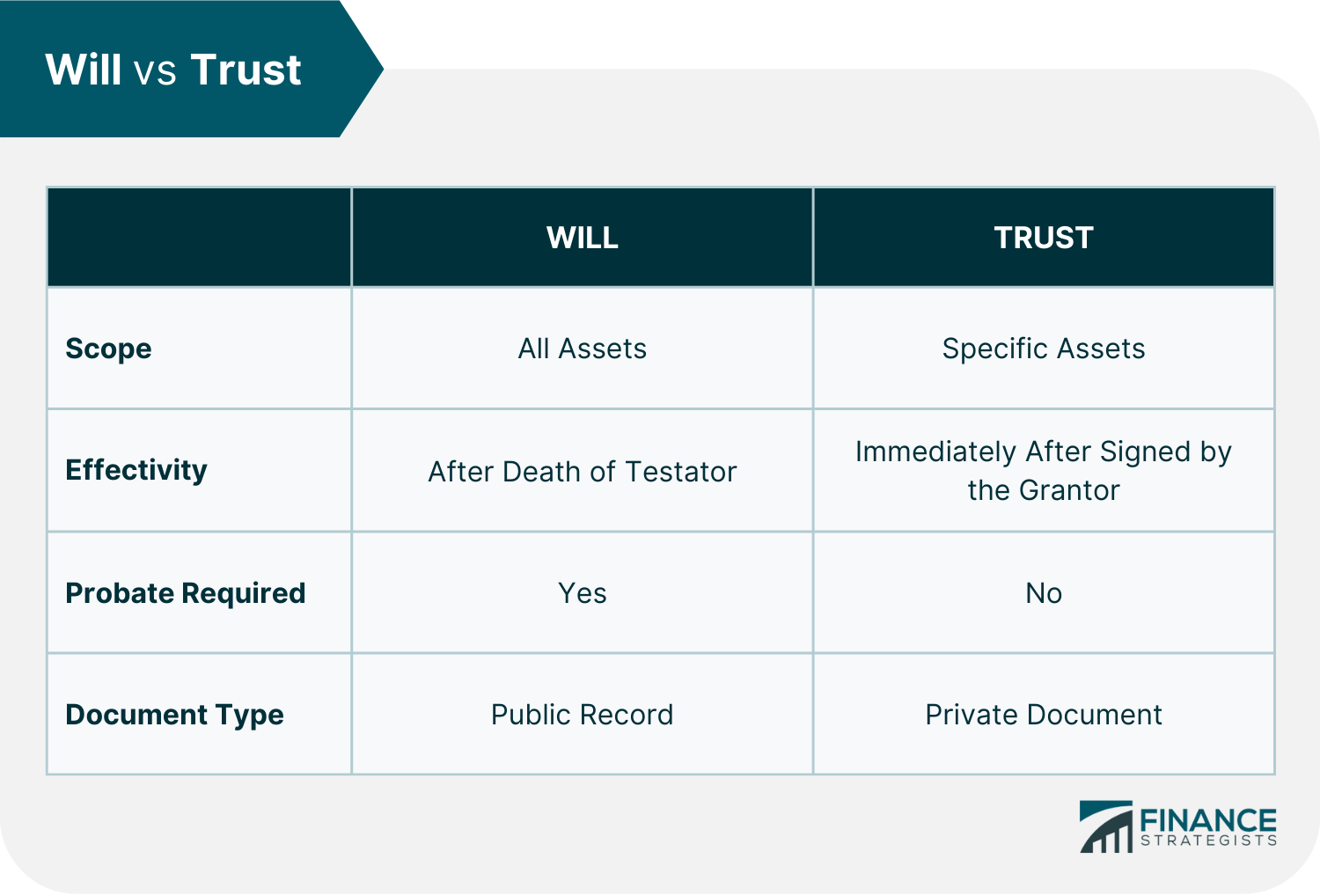

A Last Will and Testament, commonly known as a will, is a legal document used in estate planning that contains instructions for distributing wealth and caring for minor children after the testator's death. A will must be duly signed, notarized, and updated. In the event of death without a valid will, the state will determine how assets will be distributed based on the governing laws. It is essential to have a will in place so your family is not confused about what you would have wanted. It also gives you peace of mind knowing that your affairs are in order and that your final wishes will be fulfilled. Have questions about Wills? Click here. There is no set template for this legal document. However, it has general parts, which are outlined below: Some wills may have more provisions depending on the immensity of the testator’s properties and his conscientiousness to details. The person making the will is referred to as the testator. This portion contains the complete name, residential address, marital status, and other important information about the testator. When drafting the will, the testator must be at least 18 years old and have a sound mind to behold a testamentary capacity. The testator must also voluntarily sign the will without any improper and undue influence. The executor is the person designated to carry out the wishes expressed in the will. The spouse, an adult family member, a close friend, and lawyer, or an adult child may be named executor. Joint executors are also allowed. Beneficiaries are individuals or organizations named to receive the assets from the deceased's estate. Primary beneficiaries are the first in line to acquire certain assets. Contingent or secondary beneficiaries are individuals or organizations who are next in line. The distribution of assets, the “who gets what,” is outlined in a will. This is done by making an inventory of all the assets like real estate properties, investments, bank accounts, businesses, personal items, and more. In this part of the document, you can be specific about who gets what from your estate. Parents with minor children appoint a guardian to look after them. This is one of the biggest motivations for parents in drafting a will. The guardians will have the legal authority to care for children and handle their finances until they reach the age of majority. A will is essential for anyone over the age of 18 with assets and children. Assets may include savings, investments, real estate properties, and other valuables. Parents with minor children must have legally designated guardians appointed in the will. If a person dies without a will in place, intestate succession rules will apply. Generally, assets will be divided among surviving spouse, children, parents, or other relatives based on state laws and court rulings. There are multiple types of wills. Some of the most common are listed below: As the name implies, a simple will is the most basic type. The purpose is mainly to record your basic wishes without numerous clauses or stipulations. The essential parts of a will are also included. It appoints an executor to ensure your instructions are appropriately adhered to. You may also specify the distribution of your assets and the appointment of guardians for minors. A simple will might not be sufficient if you amass huge wealth by the time of your passing. This is because a simple will does not contain the detail needed to help your family members apply for any potential estate taxes that could be owed to state and federal departments. As the name suggests, a joint will is created by a married couple to meet their estate planning needs within one document. This also streamlines the estate plan because the other inherits all of their property when one spouse dies. When the second spouse passes away, then their children typically inherit everything. A joint will is a single will for two people that becomes unchangeable after one partner dies. If both parties are alive, though, the will can be modified. A will that is handwritten and signed by the testator but not witnessed is called a holographic will. This comes from the less common secondary meaning of "holograph," which is a document hand-written by its author. These types of wills are often used when there is no time to find witnesses, for example, if the testator is trapped in a life-threatening accident. While some states do not consider holographic wills legal, others require that the will meets specific standards before it can be accepted. For example, the testator must have written the document and been of sound mind when doing so. Even if these requirements are met, a lack of witnesses often leads to disputes about whether or not the will is valid. An oral will is a type of will that is spoken out loud instead of written down. These types of wills are not accepted in every state, but there are often strict witness requirements for those states that do allow them. So, if you are considering an oral will in a state that allows them, be sure to meet the necessary witness stipulations. It is among the least recognized wills because the testator verbally articulates their desires before others. Since there is no written record, or at least one not organized by the testator, courts do not generally view these types of wills as substantial. Even though it is often misconstrued, a living will actually operates quite differently than a regular will. A living will, also known as an advance directive, is a document that states your specific medical wishes in the event you become incapacitated and cannot communicate them yourself. Because of its function, living wills have nothing to do with what happens to your belongings after you die. While they might not serve the same purpose as regular wills, living wills are still critical, especially for older adults. In fact, having both types of wills in place is ideal as you age. Creating a will is beneficial because it allows you to choose who handles things after you are gone - making life easier for everyone involved. The court system will assign an administrator to handle your estate if you do not have a will. This can cause significant delays, money problems, and extra stress on those you love. Use a will to designate who inherits your assets and property and cut out those you do not want. A will enables you to specify who gets which of your assets. You can name people as beneficiaries for particular items or groups of belongings. The “residuary” estate goes to whomever you appoint for possessions you have not allocated. Your executor is responsible for ensuring all these are taken care of after you die. If you have a complicated family, your loved ones will have to try and guess what your final wishes were. This lack of clarity can cause tension among family members, which sometimes lasts for a long time. However, having a will drawn up eliminates this problem. While a last will and testament can fulfill many estate planning needs, there are some things it cannot do. A few examples of these include: Although an estate planning attorney can quickly draft you a will, it is still important to familiarize yourself with the steps to take in writing a will, the costs involved, and the common mistakes to avoid when writing one. To ensure everything is covered, below are the essential steps to take when writing a will. 1. Create an inventory of your assets. List all your assets, including real estate properties, bank accounts, investments, businesses, and personal items. Remember to include the contents of safe deposit boxes, family heirloom items, other valuable items, and collections. 2. Choose your beneficiaries. Decide on who you want to inherit specific properties. Identify the recipients of certain assets in another document called a letter of instruction, which should be kept with the will. The letter of instruction is typically less formal than the will and can provide your executor with additional helpful information for settling your estate. This may include account numbers, passwords, or burial instructions. Other documents that might be included alongside the will, such as a power of attorney, medical directive, or living will, can give guidance to the court on how to handle matters if a person becomes physically or mentally incapacitated. 3. Appoint an executor. Choose the person with whom you entrust the execution of your will with complete confidence. Notify this person of this appointment so he will be aware of his future responsibilities. Your will should allow your executor to pay your bills and creditors on your behalf so they can handle any related problems not mentioned in the will. 4. Appoint a guardian for your minor children. Parents with minor children will have to decide on the appointment of a guardian to look after them. This ensures that children will be cared for by someone trustworthy who will have the parents’ best interests at heart. 5. Affix the signature and have the will notarized. The witness to a will should be a legal adult and a disinterested party. In most states, this age of legality is 18. A disinterested party does not stand to gain anything from your choices and has no financial or personal investment in the outcome. Some states require two or more witnesses. While a lawyer can be an ideal choice for a witness, if that specific lawyer also prepared the will, they should not serve as one of the witnesses. 6. Keep your will in a safe place. While a fireproof safe is the best option, some people use a safe deposit box at their bank. However, it can be difficult for survivors to access after an owner's death. 7. Make constant updates to your will. This should be updated if there are major life events like marriage, divorce, changes in property ownership, death, and moving to another state or country. Otherwise, it is recommended to do so every 3-5 years. The greatest mistake you can make is not paying attention to the rules. Depending on your state, the rules will vary regarding age limits and witnesses. Do your research or talk to a professional so that all your bases are covered. Another crucial mistake people often make is designating the wrong executor. The executor is responsible for making sure your final wishes are carried out, so it is crucial to choose someone competent whom you trust wholeheartedly. It is important not to forget to update your will as you age. With time, your financial and personal situation changes. Updating your will allows you to reflect on those changes. Executors should also have an original copy of your will to administer your estate legally. Without it, they may run into a bit of trouble getting a grant of probate to manage your affairs. While having a DIY will is cost-friendly, consulting or hiring a lawyer is better because their experience and expertise can help manage and minimize these mistakes. The fee for a simple will starts at $150, especially if you opt to have a DIY will through online templates. Some websites are free, but most offer this service at a minimal fee. When working with an attorney, fees range from $300 to $1,000 for a basic will. The fees would differ depending on the meticulous nature of the process, the enormity of assets involved, and other relevant factors. There are things that should not be included in your will. These are the following: A will is a legal document that lays out your wishes for how all your assets will be distributed after you die. A trust, on the other hand, is an arrangement where someone (the grantor) gives another person (the trustee) the right to manage clearly defined assets for specific persons. A will takes effect after the testator dies, while a trust takes effect as soon as it is created and signed by the grantor. A will needs to go through the probate process in order to transfer assets to chosen beneficiaries, whereas a trust can bypass this process entirely. A will is generally a public record, while a trust is a private document. Individuals who die without having written a valid will are called "intestate." In this case, the state oversees the distribution of assets rather than the deceased’s personal wishes. This often means that half your estate goes to your spouse and the other half to any children you may have. However, this scenario can sometimes pose complex challenges for a surviving spouse who might need those assets to maintain a quality of life. If you have children who are minors, the court will appoint a guardian to look after their interests, including inheritance and financial assets. Having a will establishes a sound asset distribution process after you pass. You can choose to have it simple, with one person inheriting everything, or detailed, with multiple beneficiaries looking after specific properties. However, different circumstances call for different needs. There is no such thing as one rule fits all. It is best to consult and hire a legal professional to smoothen this process. If you do not have a will yet, or if what you have is out of date, now is the time to take care of it. Draw up a new will or update your old one, so your loved ones are taken care of according to your wishes. It is one of the most important things you can do for them.What Is a Will?

Parts of a Will

Testator’s Information

Executor

Beneficiaries

Disposition of Assets

Designation of Guardians

Who Needs A Will?

Types of Wills

Simple Will

Joint Will

Holographic Will

Oral Will

Living Will

Benefits of a Will

Limitations of a Will

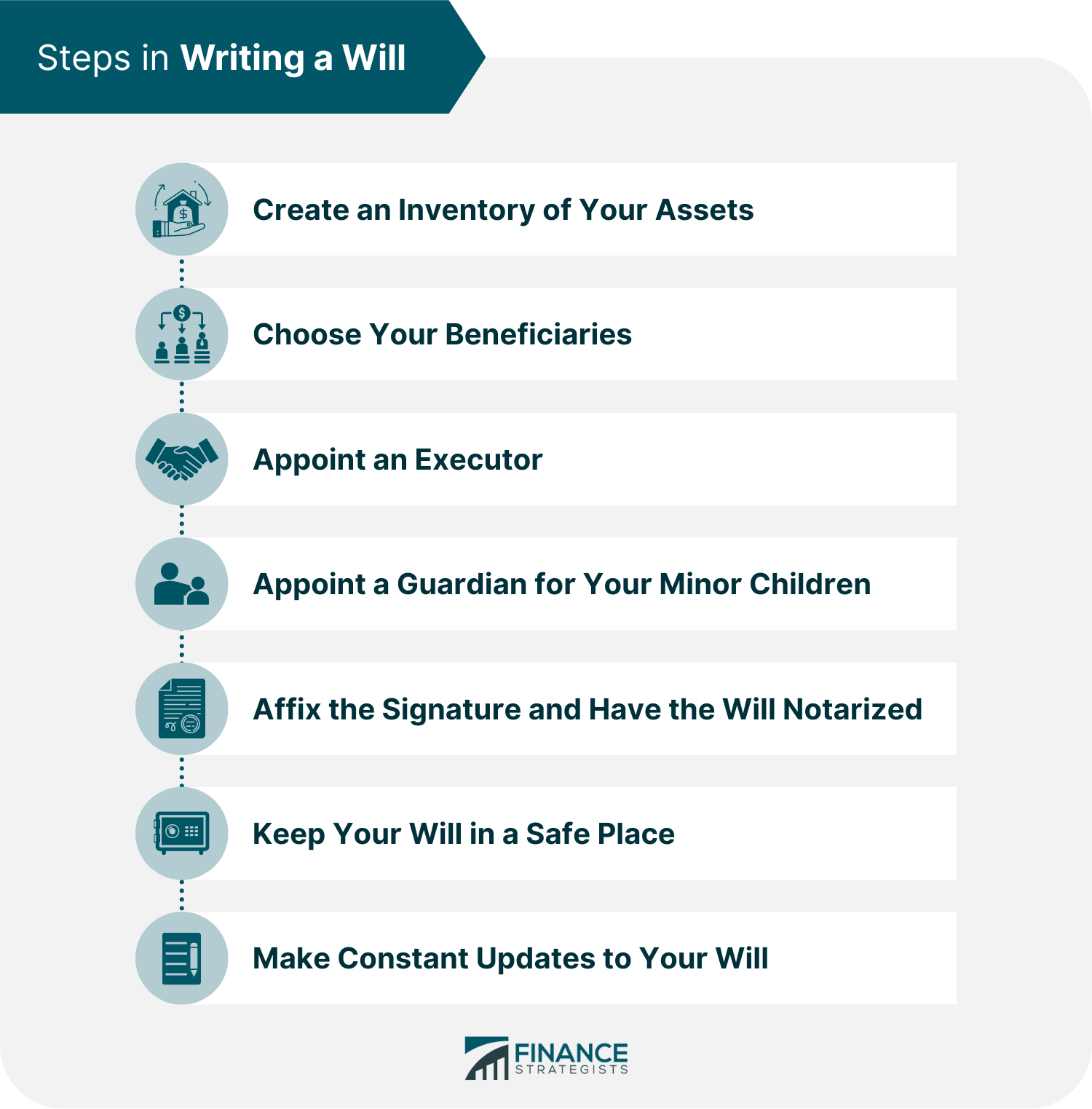

How to Write a Will

Steps

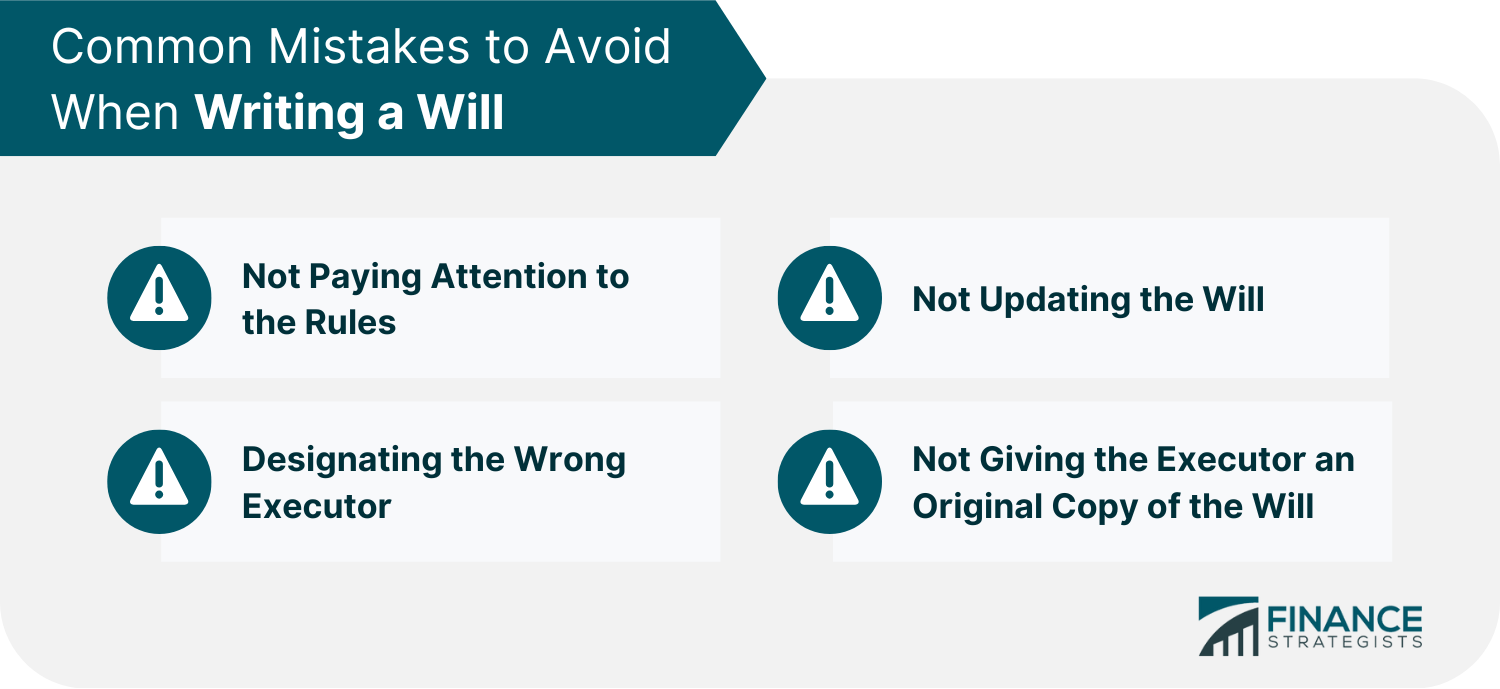

Common Mistakes to Avoid

Costs

What Not to Put in a Will

This refers to things you have bought online, like items on iTunes, eBooks, videos in the cloud, etc.

While these can not be included in an official will, you can name a "Digital Executor" in your records who will have permission to manage your accounts after you pass away.Wills vs Trusts

What Happens if You Do Not Have a Will?

Final Thoughts

Will FAQs

This should be updated if there are major life events like marriage, divorce, changes in property ownership, death, and moving to another state or country. Otherwise, it is recommended to do so every 3-5 years.

The purpose of a will is for the smooth distribution of your assets when you pass away. It gives you the authority to ensure your family and beneficiaries receive the inheritance as you prepared for them.

Yes, married couples can share a will known as a joint will. A joint will is a single will for two people that becomes unchangeable after one partner dies. If both parties are alive, though, the will can be modified.

The fees range from $150 - $1000 depending on the type of will and the enormity of your assets if you do it through an online template or hire an attorney. There are websites, though, that provide templates for free.

No. Simply having a will does not avoid probate. A will must go thru probate, where the document is filed in court before the executor can distribute the assets accordingly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.